Have you ever questioned how the world’s goods and offerings seamlessly travel throughout borders, fueling worldwide change and riding economic increase? And have you ever ever taken into consideration the demanding situations and dangers businesses face when it comes to financing those transactions? Well, exchange finance is the backbone of worldwide commerce, ensuring that the wheels of worldwide exchange hold turning.

But right here’s the trap you want to recognise: conventional change finance techniques may be complex, gradual, and liable to mistakes and fraudulent activities. In fact, according to a study by the International Chamber of Commerce (ICC), up to 80% of global trade relies on some form of trade finance, and yet, 1.5 trillion dollars of trade finance requests are rejected or delayed each year due to these inefficiencies.

But fear no longer! There is a game-converting technology at the upward thrust that has the capability to convert exchange finance as we comprehend it. Enter blockchain, a progressive decentralized generation that is reshaping industries throughout the globe. By using the power of blockchain, change finance may be simplified, multiplied, and made more secure.

So, how does blockchain fit into the picture?

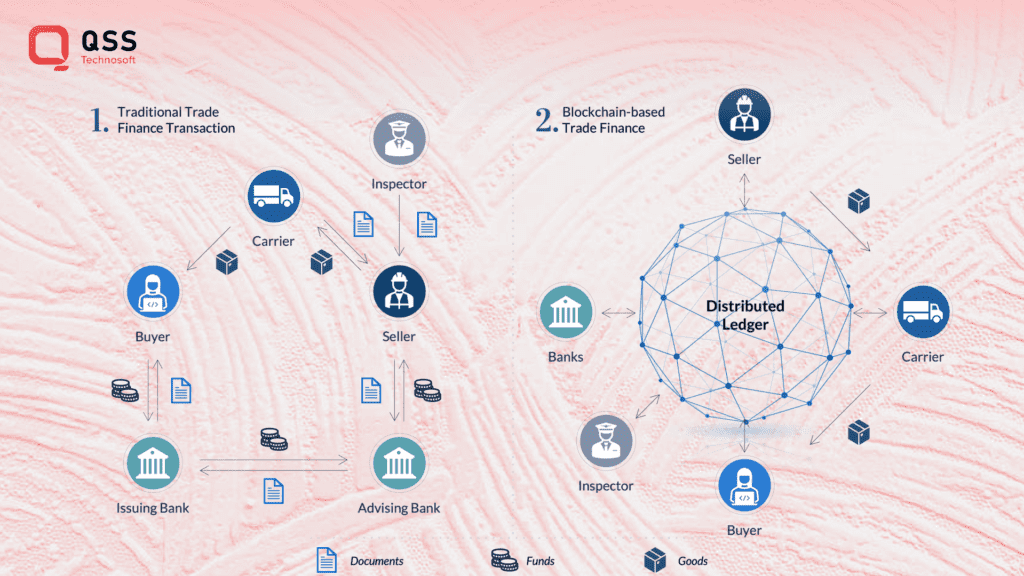

Picture this as a situation: a small business in India wants to export goods to a client within the United States. In a conventional change finance manner, there are a couple of intermediaries concerned, together with banks, customs authorities, insurers, and logistics providers. Each step requires massive documentation, verification, and communication, mainly due to delays and capability mistakes.

Now, let’s introduce blockchain into the mix. With blockchain, all parties involved in the trade can have access to a shared and immutable ledger that records every transaction and related document. This not only eliminates the need for multiple copies of documents but also enables real-time verification and transparency throughout the entire trade finance process.

Make sure to read this blog till the end because today we are going to explore more about blockchain in trade finance.

Read Also: How AI and Blockchain Are Reshaping the Insurance Sector?

Understanding Blockchain in Trade Finance

In trade finance, various parties are involved, including banks, exporters, importers, and other intermediaries. The current process involves multiple paper-based documents, manual verification, and numerous intermediaries, leading to delays, errors, and high costs.

Blockchain technology can significantly transform this process by providing a secure and transparent platform for recording and verifying transaction data. Each transaction is recorded in a block, and once verified by network participants, it is added to the chain, creating an unalterable record.

For example, the Singapore-based blockchain platform, Contour, has successfully facilitated the digitalization of trade finance processes by connecting banks, corporates, and other stakeholders. By using blockchain technology, Contour has reduced the time needed to process trade finance transactions from an average of 10 days to just 24 hours.

This is just one example of how blockchain is revolutionizing trade finance. The potential is enormous, from reducing fraud and mitigating risks to improving efficiency and simplifying cross-border transactions. The traditional trade finance landscape is ripe for disruption, and blockchain is poised to lead the way.

Benefits of Blockchain in Trade Finance in Global Commerce

Blockchain technology is revolutionizing global commerce, particularly in the realm of trade finance. With its distributed ledger system and smart contract capabilities, blockchain enables secure and efficient transactions, streamlining the entire trade finance process.

Let’s explore some of the key benefits that blockchain brings to trade finance in the era of global commerce.

- Enhanced Security: Blockchain’s decentralized network ensures the security and immutability of trade data. Every transaction is recorded in a transparent and tamper-proof manner, reducing the risk of fraud and ensuring the integrity of trade finance activities.

- Efficient Transactions: With traditional trade finance processes involving multiple intermediaries, document exchanges, and manual verification, transactions can be time-consuming. Blockchain simplifies the process by eliminating intermediaries and automating document verification through smart contracts. This greatly speeds up transaction settlement and reduces paperwork, leading to faster and more efficient trade finance operations.

- Improved Transparency: Blockchain provides a transparent and auditable record of transactions, enabling all stakeholders involved in trade finance to access and verify relevant information. This transparency builds trust among parties and reduces the risk of disputes, increasing efficiency in trade operations.

- Lower Costs: By eliminating intermediaries and streamlining processes, blockchain significantly reduces transaction costs associated with trade finance. Additionally, the automated verification and execution of smart contracts reduce the need for manual labor, further reducing operational costs.

- Risk Mitigation: Blockchain’s traceability and transparency enable enhanced risk management in trade finance. Parties can easily track the movement of goods, verify their authenticity, and assess creditworthiness, reducing the risk of fraud, counterfeiting, and non-payment.

One example to prove the benefits of blockchain trade finance is the partnership between the Australian Securities Exchange (ASX) and Digital Asset Holdings. ASX is replacing its existing Clearing House Electronic Subregister System (CHESS) with a blockchain-based platform. This move will enhance security, reduce settlement times, and lower costs in the Australian equity market.

Another notable example is IBM’s collaboration with shipping giant Maersk to develop TradeLens, a blockchain-powered platform. TradeLens aims to digitize and streamline global supply chains, enabling more transparent and efficient trade finance processes.

Future Outlook of Blockchain in Trade Finance

The adoption of blockchain in trade finance is still in its early stages. The traditional trade finance process is often laden with inefficiencies, paperwork, and delays. However, with its transparent, secure, and decentralized nature, blockchain has the potential to streamline and transform trade finance operations.

Streamlining Trade Finance Challenges

Blockchain can improve trade finance by overcoming key challenges such as documentation, fraud, and verification. Smart contracts, self-executing code on the blockchain, can automate the processing of trade documentation, reducing the need for manual intervention and improving efficiency. In fact, a World Economic Forum study estimated that blockchain could reduce trade finance costs by up to 20%.

Statistical Data Supports the Potential

Statistical data supports the promising future of blockchain in trade finance. According to a survey by Deloitte, nearly 85% of trade finance executives believe that blockchain will have a positive impact on the industry. Furthermore, in a joint report by TradeIX and R3, it was projected that by 2026, the adoption of blockchain in trade finance could generate $1.1 trillion in new trade and add $3.4 trillion to global GDP.

Read Also: Blockchain development for Gaming Apps: A New Era of Play-to-Earn Opportunities

Real-World Examples

Several real-world examples showcase the potential of blockchain in trade finance.

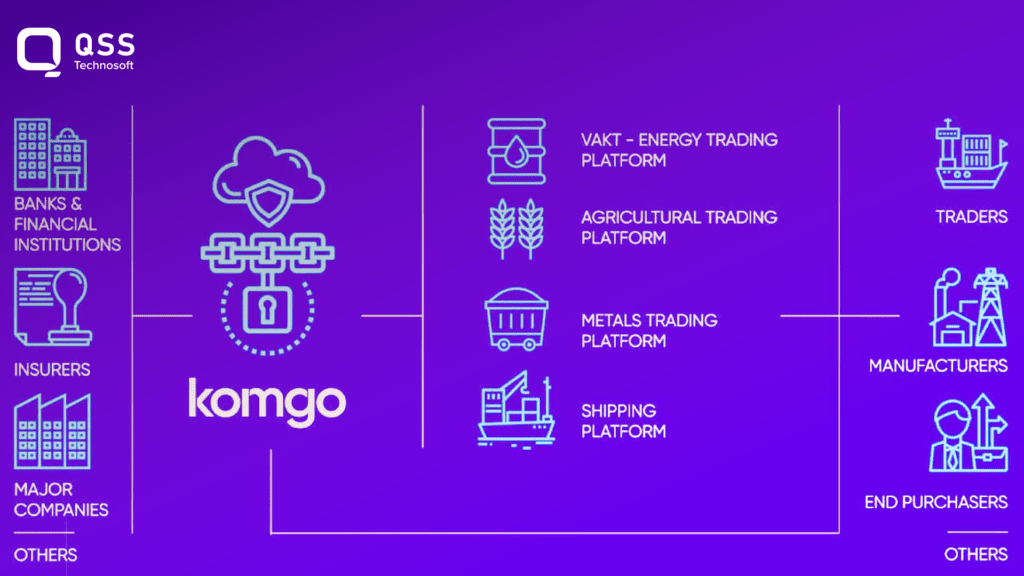

- Komgo: Komgo is a blockchain-based platform that aims to digitalize and streamline the process of commodity trading. It enables participants in the commodities market, such as traders, banks, and inspectors, to collaborate securely and efficiently. By using blockchain technology, Komgo provides transparency and immutability to trade documents, reducing fraud and improving trust among participants.

- We. Trade: We. Trade is a blockchain-based trade finance platform that focuses on facilitating cross-border transactions for small and medium-sized enterprises (SMEs). The platform provides a secure environment for businesses to initiate, track, and finance trade transactions, all while leveraging smart contracts and blockchain technology. It aims to reduce the complexity and cost of international trade for SMEs.

- HSBC’s Voltron: HSBC, in collaboration with other major banks, developed Voltron, a blockchain platform for digitizing and automating the process of issuing and managing letters of credit (LCs). By digitizing LCs on the blockchain, Voltron eliminates the need for physical paperwork, reduces processing time, and enhances transparency between importers, exporters, and banks.

- Ant Financial’s Ant Blockchain Open Alliance: Ant Financial, the financial arm of Alibaba Group, launched the Ant Blockchain Open Alliance to provide a blockchain-powered platform for cross-border trade finance services. The platform enables SMEs to access financing, manage supply chains, and verify trade information in a more efficient and transparent manner, ultimately accelerating the growth of global trade.

- Singapore’s Project Ubin: Project Ubin is an initiative led by the Monetary Authority of Singapore (MAS) to explore the use of blockchain technology in trade finance and payments. The project aims to enhance efficiency and security in Singapore’s financial industry. It has successfully conducted trials using blockchain to execute and settle digitalized payment and securities transactions, showcasing the potential for blockchain in the trade finance ecosystem.

Read Also: Revolutionize Mobile Gaming with Blockchain App Development using Web3

Future Outlook and Growth Potential

The future outlook for blockchain in trade finance is bright. As more companies and financial institutions recognize the potential benefits of blockchain, adoption rates are expected to rise. The World Trade Organization predicts that by 2030, blockchain-based trade finance platforms could account for 10-15% of global merchandise trade, reducing costs and increasing efficiency.

Strategies for Implementing Successful Blockchain Trade in Finance

Implementing blockchain in trade finance requires careful planning and execution. Here are some strategies to consider for a successful implementation:

- Stakeholder Collaboration: Engage with all stakeholders involved in trade finance, including banks, exporters, importers, and regulatory authorities. Collaborate to develop industry-wide standards and protocols for blockchain adoption.

- Regulatory Framework: Work with regulatory authorities to establish legal and regulatory frameworks for blockchain trade finance. Ensure compliance with anti-money laundering (AML) and know your customer (KYC) requirements.

- Scalability and Interoperability: Blockchain platforms should be designed to scale and accommodate a large number of transactions. Interoperability between different blockchain networks should also be considered to ensure seamless integration with existing systems.

- Education and Training: Provide education and training programs for stakeholders to understand the benefits and processes of blockchain trade finance. This will help in widespread adoption and acceptance.

- Continuous Improvement: Continuously monitor and assess the performance of blockchain trade finance systems. Implement improvements based on feedback and emerging technologies to optimize efficiency and security.

Challenges and How to Overcome

Implementing blockchain in trade finance is not without challenges. Some of the key challenges include:

- Regulatory Compliance: As blockchain is a relatively new technology, there may be uncertainties around regulatory compliance. Collaborate with regulatory authorities to address legal and compliance issues.

- Interoperability: Different blockchain platforms may have different protocols and standards, making it challenging to achieve interoperability. Collaborate with industry players to develop standardized protocols for seamless integration.

- Cost and Scalability: The initial investment and infrastructure costs associated with implementing blockchain trade finance may be significant. Evaluate the long-term benefits and ROI to justify the investment.

- Change Management: Implementing blockchain requires a cultural shift and change management within organizations. Engage with stakeholders early on and provide training and support to ensure smooth adoption.

Read Also: Decentralised Finance (DeFi) Apps: Unlocking Financial Inclusion with Blockchain app development

How to overcome?

At QSS Technosoft, we understand the potential of blockchain in trade finance. With our expertise in blockchain development and implementation, we can help businesses use this technology to streamline their trade finance processes. Our team of experts can design and deploy customized blockchain solutions that meet your specific requirements.

Contact QSS Technosoft today to learn more about how we can help you harness the power of blockchain for trade finance.

Conclusion

We believe that blockchain technology has the potential to transform the world of trade finance. By adopting this innovative technology, businesses can benefit from increased transparency, faster transactions, reduced costs, enhanced security, and improved access to finance.

While there may be challenges to overcome, We are confident that with the right strategies and collaboration with stakeholders, you can successfully implement blockchain trade finance and pave the way for a more efficient, secure, and transparent global commerce system. Let’s start on this exciting journey with QSS Technosoft and revolutionize the way trade finance operates.

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.