Have you ever fantasized about managing your finances from the comfort of your couch and not going out to stand in large queues? How about we say this could happen with just a few taps on your phone? Amazed? Or super amazed? This is the reality of all those millions of users who correctly use mobile banking apps such as Revolut. But behind such ease, did you ever wonder how much effort and time it would have taken to build such a smooth, sophisticated financial powerhouse?

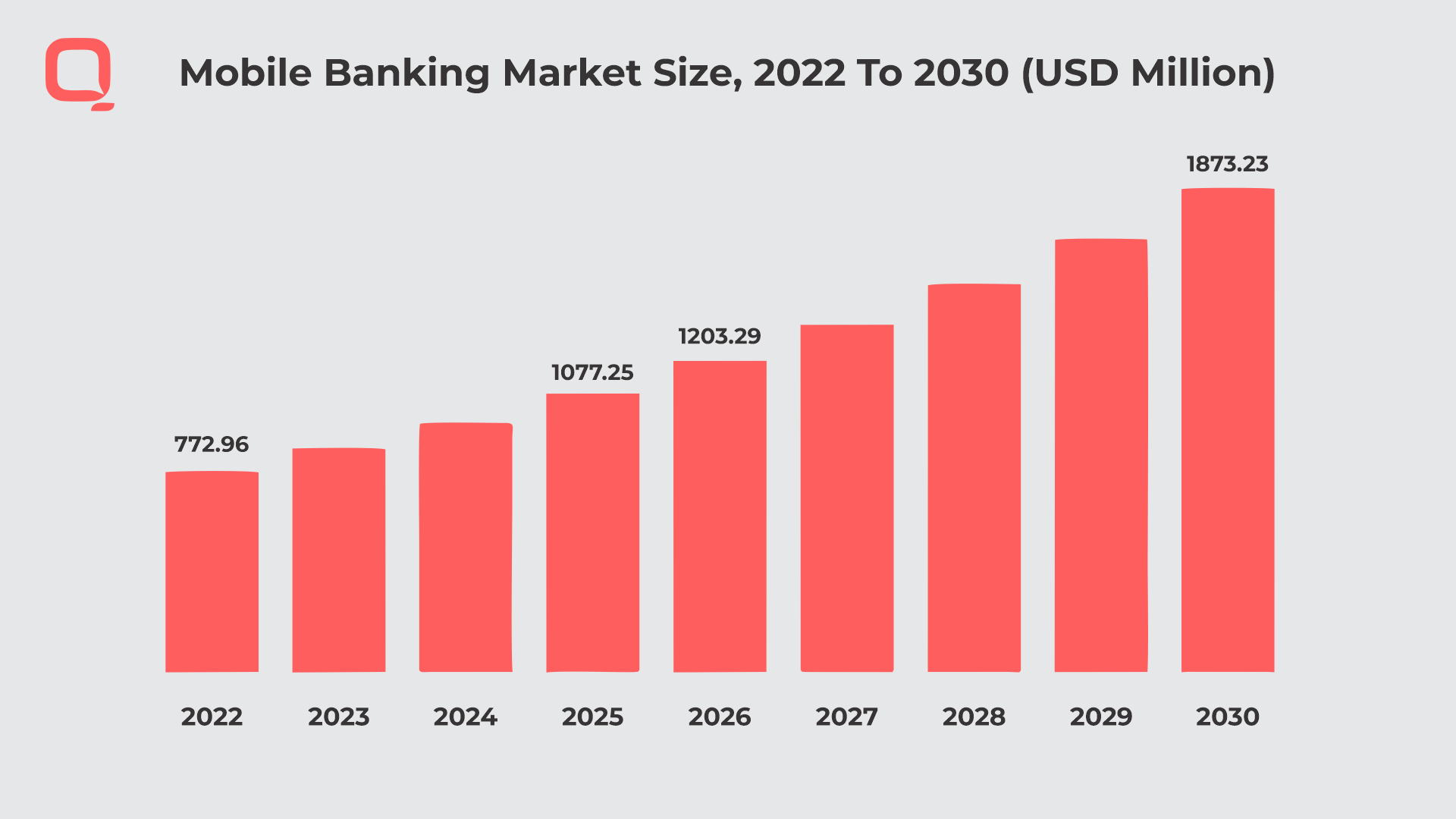

Today, it’s no lie that the mobile banking sector has been seeing a huge boom. It’s been projected that the market value of the mobile banking sector will reach over $1873.23 million by 2030.

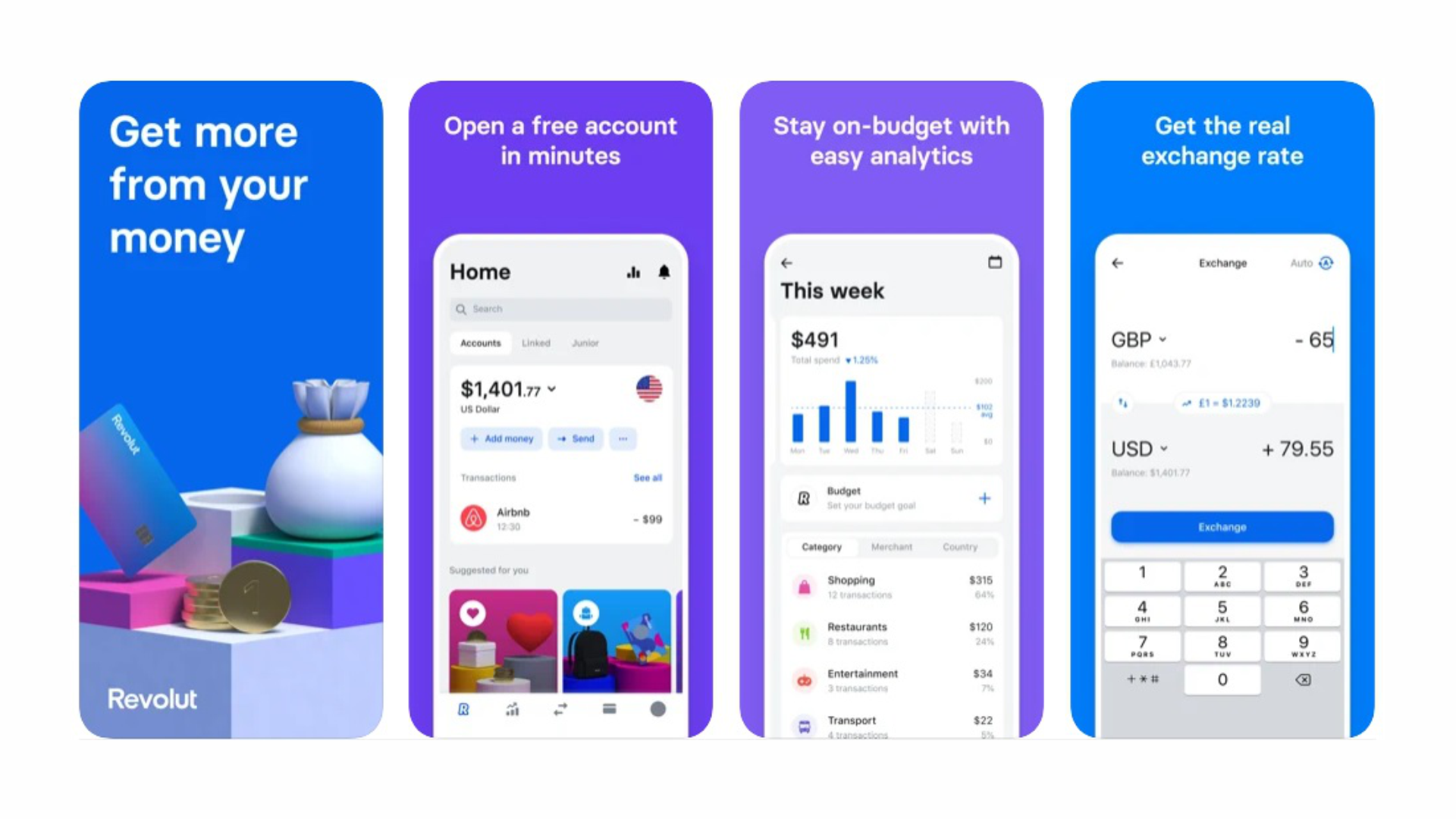

It is because of the digital lifestyles that this surge fueled up. Moreover, Revolut provides a user-friendly and sleek interface, with features like commission-free currency exchange, instant global transfers, and so much more. These features provided by Revolut are a clear instance of how and why these apps are redefining personal finance, unlike traditional forms of banking.

Imagine the last time you grappled to understand a banking statement. Did you feel frustrated at that time, or was it a seamless job for you to read those mind-boggling bank statements? Well, that was something we wanted to avoid ever coming across, and hence, Revolut. With this super seamless mobile banking solution and user-friendly interface, you can keep track of your expenses and clear all your financial bills with ease in just one click. And guess what? All this happens on your smartphone itself. How did it sound to you?

Are you amazed by the potential these mobile banking apps provide? Do you want to create one of your own and earn like a crorepati?

In this blog, we will reveal everything about these apps, how they can be created, their benefits, and the cost of building your own.

Read also:- How to Develop a Mobile App like JIO TV?

Understanding Mobile Banking App like Revolut

Today’s age is filled with digitalization, whether digital transactions or even handling finances digitally, skipping those huge and boring baking queues. Mobile banking apps have become ubiquitous. Gone are the days when we needed to stand in a queue and read those super confusing banking statements to manage our finances. Today, in the digital era, with just a few taps on our phone’s screen, you can manage your money easily. One example of such an app is Revolut. But have you ever thought about what goes behind the scenes of these evolved financial mavericks?

Mobile banking apps such as Revolut have become synonymous with innovation when managing personal finances. Moreover, their manageable interface and features like commission-free currency exchange and seamless global transfers are just a few reasons why people prefer them in a good amount.

Whether you’re a professional looking to simplify the banking landscape or even an entrepreneur looking to make money while simplifying the procedure, you must be curious, right? Curiosity can be anything, from how to build a mobile banking app to what the cost would be to build a mobile banking app like Revolut. These queries are genuine, and hence, their answers would depend upon several factors.

For Example: Let’s suppose you are on a trip to Europe. In addition to the Revolut-like app, customers can remove unwanted roaming charges. Conveniently, you can easily switch from your home currency to euros at a more reasonable exchange rate for the purchase of stuff at the local stores. You can make a payment by phone and split the dinner bill with your friends—all in a safe and cool platform.

Benefits of Investing in Mobile Banking App Like Revolut

The mobile banking revolution is in full swing, and as far as experts can tell, it’s continuing at a swift pace. Investing in a mobile banking app like Revolut can be a strategic move for several reasons: Investing in a mobile banking app like Revolut can be a strategic move for several reasons:

- Offer Competitive Advantages:

Mobile applications related to banking can provide functions that are rarely available in old established banks. Consider lower fees:

Example: Consider the situation of a frequent traveller who saves hundreds of dollars each year on currency exchange and international money transfers through the features of their mobile banking application. The conventional bank system was accustomed to charging high commissions for such transactions, so now this app has disappeared, transforming it into a preferable option for travellers.

- Enhanced User Experience:

Mobilization apps enable users to have an experience that is in contrast to how a website operating bank is with a user-friendly and intuitive user interface. This could consequently bring about high customer satisfaction and engagement levels.

Example: Someone with a limited ability to understand such clumsy online banking is given. On a mobile banking app, such customers can query their balance, transfer funds, and pay the bills quickly. The app’s clean design and user-friendliness features make it a delight to manage funds using the application, in contrast to the annoyance of cueing with their bank’s platform.

- Integrated Financial Services:

Apps can work more into advanced banking functions rather than be limited to basic banking tasks. Visualize a range of fund proposals, budgeting tools, and shared bill options – all within the same app. Users who appreciate simple things and saving time checking their finances will be attracted to this central point for managing money.

Example: A person who wishes to contribute to savings without a background in sophisticated investment volumes. Imagine an app installed on a phone that allows students to invest directly from their phone, with step-by-step explanations and user-friendly features. It has always been challenging for students to take on this issue. Furthermore, splitting bills with friends via the app lets you stop struggling with math and leave the balance to calculate with the software; each person will put the money for the bill they owe independently.

- Budgeting and Tracking Tools:

Financial management daunts many people, and they often don’t do it properly. The app may provide budgeting tools to categorize transactions, set spending goals, and analyze spending habits, which will not only give users the power to make well-informed financial decisions but also help them plan to save better in the long run.

Example: A college student can benefit from your one-stop solution for managing the spending on textbooks, groceries, and entertainment with your app’s budgeting tool. This lets them get close to their budget and buy things but does not make them overpay.

- Simple and Intuitive Design:

The app’s friendly, user-orientated interface means even users with limited technical skills can use it.

Example: Ponder the scenario where someone without knowledge about complicated app development for finances wants to build one. The fact that your app’s interface is very basic, with obvious icons and labels, helps the users perform operations such as transferring funds or paying bills effortlessly, giving the app a positive impression on the user.

- Fast and Efficient Transactions:

The app should allow users to make bill payments and do transfers faster than other online payment services.

Example: A busy professional may pay his most existing bills in the most efficient way possible using your app’s efficient bill payment system. Customers’ transactions are completed at lightning speed while they are kept safe from fraud or scammers, thus saving them time and energy.

Read also:- How to Develop a Mobile App Like Snapchat: A Comprehensive Guide

Key Features of Mobile Banking apps like Revolut

The advent of mobile applications meant that one could bank from anywhere at any time, making this feature an integral part of financial management. Nevertheless, many apps are solely operational and unable to offer one of Revolut’s kind. These mere apps are popular but need more later functionality. The solution is surely embodied in its feature set. Let’s explore some key functionalities that can elevate your mobile banking app and attract users:

- Seamless Account Management:

This feature allows customers to track their balances, see their last transactions, and even download the statements directly from the app.

Example: Imagine young entrepreneurs checking their account balances with their phone to ensure they have enough money for the upcoming business expenditure.

- Effortless Money Transfers:

Sending and receiving pesos for local and foreign transactions should be as simple as ABC. This is particularly convenient for people who need to send money repeatedly, like freelancers or those whose families live abroad.

Example: Let’s say how a college student is sending money back to their parents who reside in a completely different country just through the app with a touch.

- Frictionless Bill Payments:

Users can make bill payments and set up reminders from this app, so there is no need for paper checks and missing due dates. This makes finance management routinely easy for buying persons.

Example: This worker has secured all bills and automatic payments for rent, electricity, or other ongoing costs.

- Intelligent Budgeting and Tracking:

The app must create categories and amounts of spending, motivate users to set saving goals and provide useful info reports to help users be aware of their financial habits. Therefore, intuitive digital banking provides people with the right information for improved financial decision-making.

Example: Visualize a person who wants to afford a flight to Hawaii for the coming Christmas. The app can group all their travel-related expenses and then see how close they are to their stated savings goal.

- Competitive Foreign Exchange:

Apps can compete with accurate exchange rates and small transaction fees, particularly for world trip enthusiasts and avid globetrotters. This allows the service provider to cater to a niche of mobile tourists who also travel to other regions.

Example: Imagine how the app can help people on business travel abroad exchange currencies at a rate that does not incur excessive transfer costs and also pay for their expenses.

- Advanced Security Measures:

Fingerprint authentication, two-factor identification, and data encryption must be implemented so that users can avoid fraud and misappropriation of their financial details. Such functionality is an essential must-have for financial apps of any kind.

Example: Imagine a fearless user who is confident enough to know that his financial information is not exposed to danger due to the strong security measures the app has applied.

Cost Breakdown to Build app Similar to Revolut

The finance world is rocking mobile apps like Revolut, and building an app like this can generate tremendous profit. However, while costs are important, it is more vital to understand what the costs may lead to. Here’s a breakdown of the factors that influence the price tag:

- App Complexity and Features

Basic Features (Account Management, Money Transfer): Transparent functionalities that drive the development of this product (and which are relatively affordable to produce) have a flat design.

Advanced Features (Budgeting Tools, Investment Options): These require more complicated coding and higher prices. Adding more features also implies higher development time and expenses.

- Development Team and Location:

In-House vs. Outsourcing: Incurring the cost of having your team on the team may result in complete control, but you will want to avoid getting one. Outsourcing to less developed countries might generate cost savings, but straight communication and quality overview are challenging.

Team Expertise: The role of your developers’ skillet is, therefore, predominant. Senior developers with extensive experience and know-how will charge more than junior developers without.

- App Platform (Android, iOS, or Both):

Single Platform: Most developers need to cover only one platform, which will reduce their expenses.

Multiple Platforms: Supporting both Android and iOS devices means you will probably have to design separate apps for each platform, which will cost about twice as much.

- Design and User Interface (UI/UX):

Simple vs. Complex Design: The key factor is a clear-cut design and simple interactions, but very advanced interfaces with multiple animations can produce a high-cost course.

Additional Considerations:

- Server Costs: Keeping the transaction rapid servers and the database up and running entails continuous investment.

- Security Features: Meanwhile, clever security measures such as 2-factor authentication are indispensable but more expensive than counterfeiting, which will be covered by the development fee.

Estimated Cost Range:

The different factors make it hard to quote a specific price, but that is the cost. To get a rough idea of the spending needed to develop an application such as Revolut, you must be ready to invest from $100,000 to $500,000+. Here’s a simplified breakdown:

Basic App (Account Management, Money Transfer): $50,000 – $80,000

Advanced App (Budgeting Tools, Investment Options): $80,000 – $100,000+

Read also:- How to Develop a Mobile App like Hinge Dating App?

Conclusion

The mobile banking space is thriving while revolutionary technologies are winning. By having a mobile banking app, you are not only leaking into this multi-billion market, but you also allow the users to manage their money without going through the hassle.

QSS Technosoft can be your spark in an all-encompassing process of creating a revolutionary app like Revolut. The experienced team of application designers will create a solid and easy-to-use app that fills the features required by a customer, such as seamless money management, intelligent budgeting, competitive currency exchange, and robust security.

Our priority is developing mutually beneficial, long-term relationships with all parties involved. We proceed by understanding your goals and by getting to know what audience you have in mind, and we form a perfect fit solution.

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.