Is it Worth Investing in Developing a Mobile Banking App Like First Direct?

Have you ever considered how our everyday financial habits are affected by mobile banking apps? Surprisingly, a recent Statista analysis indicates that over 85% of consumers in the UK utilized online banking services in 2020, demonstrating the growing trend toward digital financial management.

First Direct, with its consumer-centric approach and modern generation, has set a benchmark in the enterprise. This may additionally appear like frightening financial funding, but the ability returns are full-size. For instance, the First Direct cellular banking app has over 10,000 positive reviews at the App Store, with a median rating of 4.8 out of 5.

This demonstrates the high demand and delight of customers, indicating that making an investment in a mobile banking app may have a superb effect on the boom and achievement of organizations.

Many startups and established banks aspire to emulate its success, but the main concern that arises is the cost and investment required to develop a mobile banking app that matches the standards set by First Direct.

Hold on! In this blog, we are going to provide a comprehensive guide on cost to build a mobile banking app like First Direct. So, make sure to read this till the end.

Read Our Page : Complete Guide to Mobile App Development in 2023

Understanding Mobile Banking App like First Direct

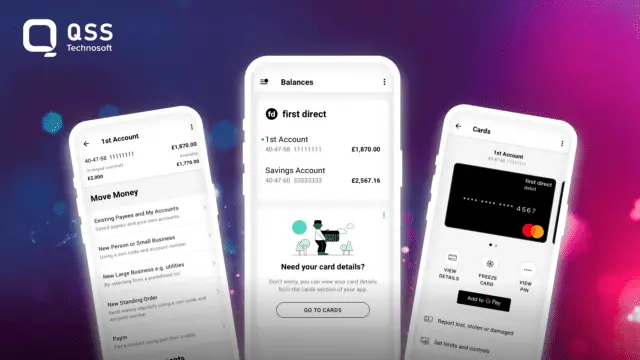

First Direct’s mobile banking app offers users a seamless banking experience with features like account management, real-time transaction updates, bill payments, fund transfers, budget tracking, and personalized financial insights. The app’s intuitive design and user-friendly interface allow customers to easily navigate through various services while ensuring data privacy and security through advanced encryption and authentication protocols.

An example of the First Direct app’s functionality could be a customer using the app to make a peer-to-peer transfer to a friend. The customer enters the recipient’s contact details, the amount to be transferred, and then verifies the transaction using biometric authentication such as fingerprint or facial recognition. The funds are instantly transferred between accounts, with both parties receiving real-time notifications of the transaction

What Are the Advantages of Mobile Banking App like First Direct

Known for its innovative features and seamless functionality, First Direct offers numerous advantages over traditional banking methods. Let’s take a look at the top benefits of mobile banking app like First Direct.

- Convenience: First Direct’s mobile banking app enables users to perform a wide range of banking transactions at their convenience, anytime and anywhere. For instance, customers can effortlessly transfer funds between accounts, pay bills, and even deposit checks by simply snapping a photo using their smartphones or tablets.

Example: The mobile banking app utilizes secure APIs to connect seamlessly with the bank’s core banking system, enabling real-time transaction processing and access to account information.

- Enhanced Security: First Direct prioritizes the security of its mobile banking app users. The app incorporates advanced security measures such as biometric authentication (fingerprint or facial recognition), multi-factor authentication, and end-to-end encryption protocols. These measures ensure that users’ personal and financial data remain protected from unauthorized access and fraudulent activities.

Example: The app employs secure authentication protocols such as OAuth 2.0 and OpenID Connect to establish secure communication channels with the bank’s servers, preventing unauthorized entities from intercepting or tampering with sensitive data.

- Real-Time Notifications: Through push notifications, First Direct’s mobile banking app keeps users informed about every transaction activity happening in their accounts. Users receive immediate alerts on their mobile devices for various activities, including card transactions, fund transfers, and bill payments.

Example: The app uses a combination of server-side event-driven architecture and WebSocket protocol to deliver real-time transaction notifications, ensuring that users receive updates promptly and efficiently.

- Access to Account Information: First Direct’s mobile banking app empowers users with comprehensive access to their account details. Users can easily check their account balances, review transaction history, and retrieve e-statements, all from within the app.

Example: The app uses APIs and secure connections to retrieve real-time data from the bank’s central database, ensuring that users have up-to-date and accurate account information at their fingertips.

- Seamless Integration: First Direct’s mobile banking app seamlessly integrates with various financial tools and services. This integration provides users with a holistic view of their financial health by allowing them to connect their banking app with external platforms such as budgeting tools, investment apps, and personal finance management applications.

Example: The app employs industry-standard API integration techniques, utilizing RESTful APIs or SDKs provided by partner services to establish secure and authenticated connections, allowing the exchange of financial data with external platforms.

- Personalization: First Direct’s mobile banking app offers personalized features and functionalities tailored to individual users. For example, the app allows users to set spending limits, create savings goals, and receive personalized financial tips and recommendations based on their spending patterns and transaction history.

Example: This uses machine learning algorithms and data analytics techniques to analyze user data, generating personalized insights and recommendations that assist users in achieving their financial goals.

- Quick and Easy Transactions: First Direct’s mobile banking app streamlines transactions, making them quick and easy for users. Features like quick pay, peer-to-peer payments, and contactless payments enable users to make instant and secure transactions from their mobile devices.

Example: They integrate with secure payment gateways and utilize tokenization to ensure the security of payment transactions, enabling seamless and secure processing of mobile payments.

- Customer Support: First Direct’s mobile banking app offers seamless customer support features, allowing users to seek assistance within the app itself. In-app chat, email, and phone call functionalities enable users to connect with customer service representatives to resolve queries or address any issues they encounter.

Example: They integrate with customer relationship management systems and chatbot platforms, utilizing natural language processing and artificial intelligence to provide automated support and instant responses to customer queries.

Read Also : How Much Does it Cost to Build React Native Based App? – QSS

What Are the Factors Affecting the Cost to Build a Mobile Banking App Like First Direct

When it comes to building a mobile banking app like First Direct, there are several factors that can influence the overall cost. These factors can vary depending on the complexity of the app and the specific requirements of the client.

- Platform Compatibility: The cost of building a mobile banking app can be affected by the number of platforms it needs to be compatible with. Developing an app for both iOS and Android can require more resources, which can increase the cost.

- Design and User Experience: The complexity and quality of the app’s design and user experience can impact the cost. Creating an intuitive user interface and ensuring a seamless user experience often require additional time and expertise, which can increase the overall cost of development.

- Features and Functionality: The range of features and functionalities required in the app can significantly affect the cost. Implementing features such as balance inquiries, transaction history, fund transfers, bill payments, and card management can increase the complexity of the app. On top of that, if features like biometric authentication or integration with third-party services are needed, it can further add to the cost.

- Security and Compliance: Building a secure mobile banking app requires robust security measures to protect customer data and transactions. Implementing encryption, secure APIs, and complying with data protection regulations can contribute to the cost. Security testing and auditing may also be necessary, which can increase the overall development cost.

- Integration: If the app needs to integrate with existing banking systems or third-party services, it can complicate the development process. Integrating with payment gateways, core banking systems, or other financial institutions can require additional effort and increase the overall cost.

- Maintenance and Support: After the initial development, mobile banking apps require ongoing maintenance and support. This can include bug fixes, updates for new operating systems, security patches, and feature enhancements. The cost of long-term maintenance and support should also be considered when evaluating the overall cost of building a mobile banking app.

Read Also : What Does it Cost to Build a Business Networking App like LinkedIn?

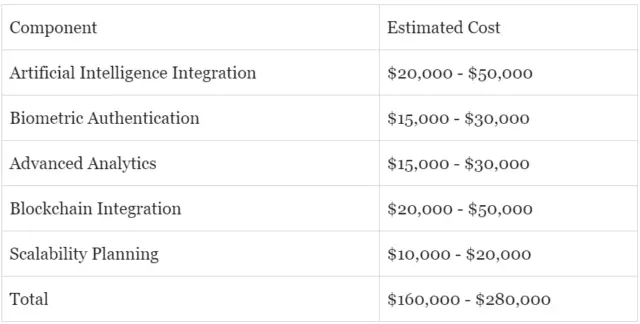

Cost Breakdown to Build a Mobile Banking App like First Direct

The estimated cost to build a mobile banking app like First Direct can range from $100,000 to $500,000 or more, depending on the aforementioned factors. Here is a breakdown of the costs involved:

1. Development Team: Hiring developers, designers, testers, and project managers is the most significant cost component.

2. Technology Stack: Costs associated with selecting the appropriate technologies, tools, and frameworks for app development.

3. Security Measures: Investing in encryption, authentication, and security protocols to protect user data and transactions

4. Third-Party Integrations: Fees related to integrating with payment gateways, banking systems, and other external services.

5. Infrastructure Costs: Hosting, server maintenance, and cloud services add to the ongoing operational expenses.

Basic Mobile Banking App Cost Breakdown:

Intermediate Mobile Banking App Cost Breakdown:

Advanced Mobile Banking App Cost Breakdown:

Note: These are only estimates and actual costs to develop app like First Direct may vary based on factors like development team rates, project complexity, and specific features required. Additionally, ongoing maintenance costs are not included in these breakdowns. For proper Quote contact QSS Technosoft team.

The Process Behind Building a Mobile Banking App Like First Direct:

Building a mobile banking app like First Direct involves a structured process that includes the following technical bullet points:

Requirement Gathering:

Identify and gather requirements for the app’s functionalities.

Ensure compliance with regulatory standards such as PSD2.

Designing UI/UX:

Create wireframes, prototypes, and final designs for an intuitive interface.

Align the design with the bank’s brand image.

Back-end Development:

Integrate the app with core banking systems and customer databases.

Establish communication and data exchange with payment gateways.

Security Implementation:

Implement strong encryption to protect customer data.

Incorporate two-factor authentication to enhance security.

Secure APIs to prevent unauthorized access.

Apply data protection mechanisms like tokenization.

API Development:

Create APIs to integrate with third-party services such as payment processors and financial aggregators.

Enable seamless data exchange and integration with these services.

Testing:

Conduct functional testing to ensure app functionalities work as expected.

Perform usability testing to evaluate the user experience.

Test for performance to ensure the app can handle user load.

Conduct security testing to identify vulnerabilities.

Deployment:

Prepare the necessary infrastructure for app deployment.

Configure servers to support the app’s functionality.

Conduct final checks before deploying the app.

Ongoing Maintenance and Updates:

Regularly maintain and update the app to address any issues.

Bug fixing to ensure optimal performance.

Incorporate customer feedback to improve app features and usability.

Stay updated with evolving technology and security requirements.

Conclusion

Developing a mobile banking app similar to First Direct entails a significant commitment in terms of time, resources, and expertise. The cost of development will depend on various factors such as the intricacy of features, security considerations, third-party integrations, and the ongoing maintenance requirements.

However, by placing a strong emphasis on delivering a seamless user experience, prioritizing robust security measures, and collaborating with a proficient development team, you can create a mobile banking app that rivals the success of renowned industry leaders like First Direct.

If you’re seeking a trusted partner to assist you in creating a cutting-edge mobile banking app, look no further than QSS Technosoft. As industry experts with extensive experience in developing financial applications, We at QSS Technosoft have the knowledge and skills required to bring your vision to life. Contact QSS Technosoft today to discuss your requirements and embark on your journey towards building a game-changing mobile banking app.

If you’re ready to take your mobile banking app to the next level, contact us at QSS Technosoft for a consultation today!

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.

How Much Does It Cost to Build a Mobile Banking App like First Direct?