If you’re in the business of mortgages, there’s a good chance you’ve thought about developing a mortgage app. After all, with more and more people doing their banking and other financial tasks online, it only makes sense to offer an app that would allow customers to manage their mortgage information on the go.

But what goes into developing a mortgage app? What are the necessary features? And how do you make sure your app stands out in a sea of other financial offerings?

In this guide, we’ll answer all those questions and more. Read on to learn everything you need to know about developing a mortgage app.

What Are The Must-Have Features Of A Mortgage App?

When it comes to features, there are a few must-haves that any mortgage app should offer. Here’s a look at some of the most important ones:

Calculators:

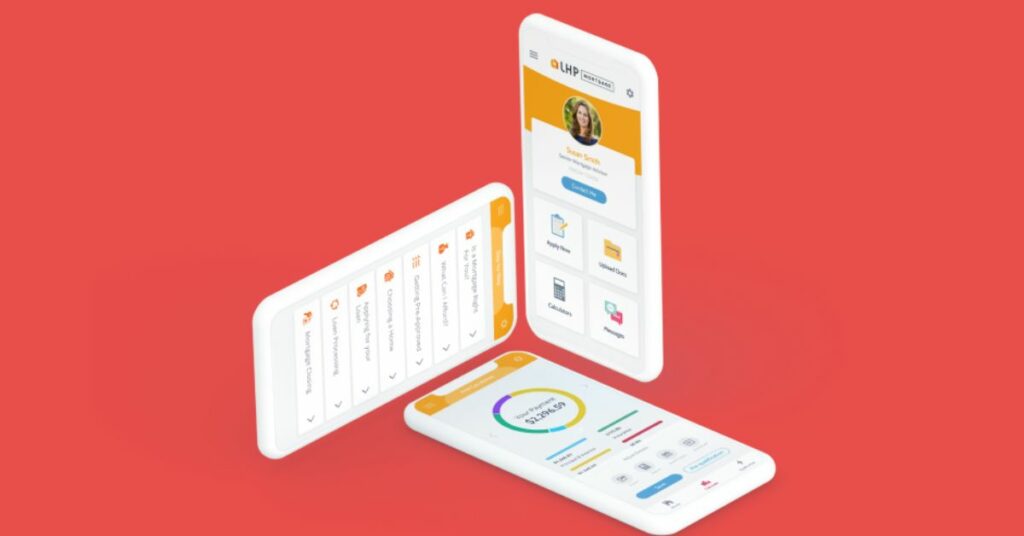

A mortgage app simply isn’t complete without a suite of calculators. Homebuyers need to be able to estimate their monthly payments, determine how much they can afford to borrow, and calculate their loan-to-value ratio. Make sure your app offers all of these calculators, and make them easy to find and use.

Loan information:

Your app should offer a complete overview of the different types of loans available, as well as detailed information on each one. This way, homebuyers can educate themselves on the different options and make an informed decision about which type of loan is right for them.

Application process:

The mortgage application process can be complicated and time-consuming. But with a good mortgage app, it doesn’t have to be. Your app should allow users to start and complete their application entirely within the app, without ever having to leave it.

Document uploading:

Along with being able to complete the application within the app, users should also be able to upload all of the necessary documents electronically. This way, they can avoid having to print out and mail in paperwork, which can save a lot of time and hassle.

Push notifications:

Keep users up-to-date on the status of their mortgage application with push notifications. This way, they’ll always know when a new document is required or when their loan has been approved.

Live chat:

Include a live chat feature within your app so that users can get help from customer service representatives whenever they need it. This way, they won’t have to wait on hold or try to navigate through a complex phone menu.

How to Develop Mortgage Apps?

Here, we’ll go over some of the key considerations for developing mortgage apps. We’ll cover the different types of mortgage products available, the underwriting process, and how to choose the right technology stack for your app.

Research the Competition

Before you start developing your mortgage app, it’s important to research the competition. This will help you understand the market and find a niche for your app.

To start, take a look at some of the most popular mortgage apps on the market, such as Zillow Mortgage, LoanDepot, and Quicken Loans. What do they have in common? What sets them apart from the rest?

Make a list of the features you like and don’t like about each app. This will help you determine what to include (and exclude) in your own app.

Define Your Target Market

Once you’ve researched the competition, it’s time to define your target market. Who are you developing this app for?

Are you targeting first-time homebuyers? Are current homeowners looking to refinance? Investors? All of the above?

Your target market will dictate the features and functionality of your app. For example, if you’re targeting first-time homebuyers, you’ll want to include features that help them understand the mortgage process and compare rates.

Mortgage products

One of the things you’ll need to consider when developing mortgage apps is what type of mortgage product you want to offer. There are many different types of mortgage products available, and each has its own set of pros and cons.

The most popular type of mortgage product is the fixed-rate mortgage. This type of loan offers a consistent interest rate over the life of the loan, which can make budgeting easier. The downside to fixed-rate mortgages is that they often have higher interest rates than other types of loans.

Another popular type of mortgage product is the adjustable-rate mortgage (ARM). ARMs offer lower interest rates than fixed-rate mortgages, but the rate can change over time. This can make budgeting more difficult, but it can also save you money if interest rates go down.

Understanding the underwriting process

Once you’ve decided on the type of mortgage product you want to offer, you’ll need to understand the underwriting process. The underwriting process is how lenders determine whether or not you’re a good candidate for a loan.

Many factors go into the underwriting process, but some of the most important ones are your credit score, employment history, and debt-to-income ratio. Lenders will also look at your property’s value and the amount of money you’re asking for.

Choosing the right technology stack

Finally, you’ll need to choose the right technology stack for your mortgage app. The technology stack is the combination of programming languages, frameworks, and libraries that you’ll use to build your app.

There are many different technology stacks available, but some of the most popular ones are the MEAN stack and the LAMP stack. The MEAN stack is a JavaScript-based stack that’s well-suited for building dynamic web applications. The LAMP stack is a Linux-based stack that’s often used for building database-driven applications.

No matter what type of mortgage product you’re looking to offer or what technology stack you choose, it’s important to get everything right to create a successful application. By following the tips in this guide, you’ll be well on your way to developing a mortgage app that meets the needs of your users.

How Do You Make Sure Your Mortgage App Stands Out?

Now that you know what features your mortgage app must have, it’s time to focus on making it stand out from the competition. Here are a few ways to do that:

Make it user-friendly:

One of the most important things to focus on is making your app as user-friendly as possible. Homebuyers should be able to easily find the information and tools they need, without feeling overwhelmed or frustrated.

Think outside the box:

When it comes to design, don’t be afraid to think outside the box. Your app should have a unique look and feel that sets it apart from other financial apps on the market.

Make it personal:

Another way to make your app stand out is to make it personal. Include features that allow users to customize their experience, such as loan recommendations based on their individual financial situation.

What Are The Benefits Of Developing A Mortgage App?

There are plenty of benefits that come along with developing a mortgage app. Here are just a few of them:

It’s convenient: One of the biggest benefits of a mortgage app is that it’s incredibly convenient. Homebuyers can manage their loan information and documents entirely from their mobile devices, which makes the process much simpler and less time-consuming.

It’s accessible: Mortgage apps are also highly accessible. Homebuyers can access them from anywhere, at any time. This is especially helpful for those who need to apply for a loan but don’t have the time to go into a bank during traditional business hours.

It’s informative: A good mortgage app will also be very informative. It will provide users with all of the information they need to make an informed decision about their loan. This includes things like loan rates, fees, and repayment terms.

It’s interactive: Another benefit of a mortgage app is that it can be highly interactive. This is thanks to features like live chat and pushes notifications, which allow users to get help or updates without ever having to leave the app.

It’s efficient: Mortgage apps are also very efficient. They streamline the entire loan process and make it much easier for homebuyers to get the information they need. This can save a lot of time and hassle, which is always a major plus.

What Are The Costs Of Developing A Mortgage App?

The cost of designing a mortgage app will vary depending on a number of factors, such as the features you want to include and the platform you want to develop for. However, in general, the cost of developing a mortgage app will fall somewhere between $5,000 and $50,000.

Of course, the exact cost will depend on your specific needs. If you want a highly customized app with a lot of features, you can expect to pay more. On the other hand, if you’re looking for a basic app with only a few features, you can expect to pay less.

The best way to get an accurate estimate of the cost of developing a mortgage app is to contact a professional app development company. They’ll be able to give you a more accurate estimate based on your specific requirements.

In Conclusion

Developing a mortgage app can be a great way to improve your business and attract new customers. However, it’s important to weigh the risks and benefits before making a decision. If you’re not sure if an app is right for you, consider talking to a professional app development company. They can help you determine if an app is the right solution for your business.

Why Choose QSS Technosoft Inc.?

There are many reasons to choose QSS Technosoft Inc. for your mortgage app development needs. We have a team of experienced developers who can create a custom app that meets your specific requirements. In addition, we offer a money-back satisfaction guarantee so you can be sure you’re getting the best possible value for your money.

We also offer a free consultation so you can discuss your app development needs with us. This way, you can be sure you’re making the best decision for your business. Contact us today to schedule a consultation.

Guide to Develop Mortgage Apps