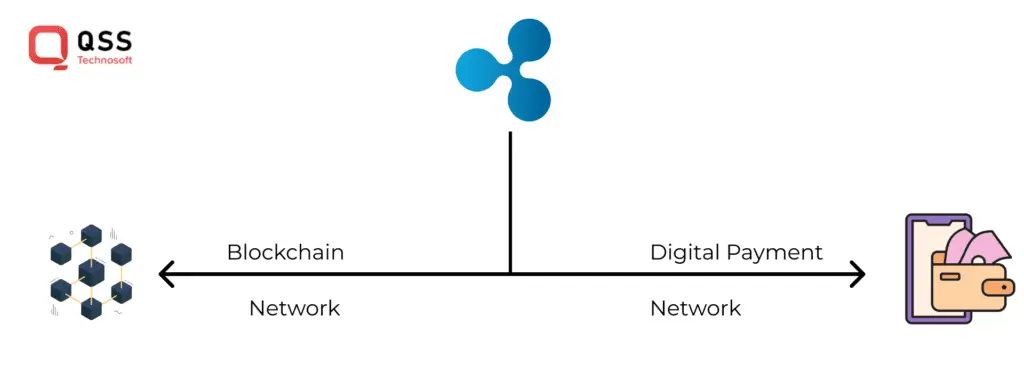

Ripples Blockchain has emerged as a standout with the advent of various digital currencies, reshaping how we picture cross-border transactions and financial infrastructure. It is a digital payment protocol, and a cryptocurrency devised to transform the way financial institutions process international transactions.

Launched in 2012 by Ripple Labs, it focuses on enabling immediate, low-cost, and secure global transaction settlements. It offers money transfer solutions through a direct path rather than involving many intermediaries like traditional banking systems do. Ripple aims to eliminate the delays and additional costs due to intermediaries in the traditional methods.

Understanding Ripple Blockchain- What is XRP?

Ripple network has its own native cryptocurrency called XRP. It facilitates transactions and ensures they have a constant flow. Here’s what you need to know about XRP:

- Transaction Facilitation: It can act as an intermediatory bridge between different currencies. This is critical in saving on transaction costs and time consumed during the process.

- Liquidity Provision: To ensure an adequate amount of liquidity and smooth transactions across borders, financial institutions can keep XRP as reserves.

- Transaction Fees: XRP is used to pay transaction fees through the Ripple network. It is the best platform with minimal fees and reduced security threats.

- Fixed Supply: Unlike several other cryptocurrencies available today, XRP has a set of limited supply of 100 billion tokens. This restricted supply aims to avert inflation and enable currency value preservation.

Also Read :- Generative AI in Creative Industries: Transforming Art, Music, and Content Creation

How Does Ripple Blockchain Function?

In comparison to other cryptocurrencies, Ripple’s technology is based on the Ripple Protocol Consensus Algorithm (RPCA) instead of using proof-of-work or proof-of-stake systems. Let’s explore how ripple function-

- Decentralized Network: Ripple works as a decentralized network of independent servers known as validators. These validators include both- the financial institutions and individual nodes.

- Consensus Mechanism: Ripple uses a consensus mechanism where validators agree on transaction validity, unlike other currencies such as bitcoin where mining or staking is used. This helps ensure efficient and faster transactions.

- Ledger System: Ripple has a distributed ledger system that keeps track of all the transaction activities. This is a transparent and secure ledger because it is updated every second. What makes it a differentiator is that it uses one continuing chain of transactions rather than blocks, as used by traditional methods.

- Instant Settlement: Ripple solves the problem of traditional banking systems by instantly settling transactions on a real-time basis. Thus, users do not require to wait for several days to process cross-border payments hence this speed gives an advantage over other platforms.

How Is Ripple Different from Other Cryptocurrencies?

What makes Ripple unique and improved? Rather than creating new financial systems, ripple focuses on improving the existing ones. This helps it focus on providing detailed and more specific solutions. Let’s explore some other ways in which Ripple differentiates itself from other cryptocurrencies:

Institutional Focus:

Unlike other cryptocurrencies that mainly serve individuals, Ripple targets financial institutions with solutions that can be integrated into conventional banking systems.

Consensus Mechanism:

The efficiency and speed of Ripple’s consensus protocol contrasts sharply with the energy-consuming proof-of-work and proof-of-stake mechanisms used by other cryptocurrencies.

Regulatory Navigation:

Unlike many decentralized cryptos that operate within the regulatory grey zone, Ripple actively interacts with regulators and seeks compliance.

Technology Integration:

Banks and payment service providers find it easier to adopt and work with Ripple’s technology since it fits well into the current financial infrastructure.

This regulatory and work mechanism makes Ripple unique and a differentiator from other digital currencies and platforms. Now let’s locate how Ripple is different from Bitcoin-

Comparing Blockchain Currencies- Ripple vs Bitcoin

Ripple Blockchain Applications in Real-World

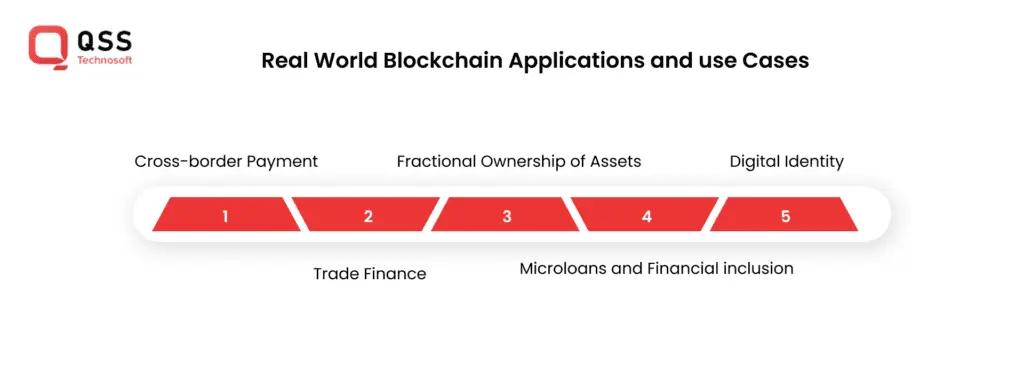

The innovation of Ripple Blockchain has brought greater convenience and affordability to the market. From cross-border payments to international partnerships, Ripple blockchain applications are numerous, such as-

- Cross-Border Payments: The primary reason for Ripple’s existence is to enable international money transfers. Its technology is used by leading banks and other financial institutions to simplify and expedite global settlements.

- Remittances: Ripple enables people to send money across countries at an affordable cost using helpful remittance services, especially for those in developing nations relying on remittances.

- Institutional Partnerships: Some financial institutions such as Standard Chartered, Santander, and American Express have joined hands with Ripple indicating its practicability in improving traditional financial systems.

- Central Bank Digital Currencies (CBDCs): Ripple participates in the development of CBDCs by offering its technologies to central banks looking to create digital alternatives to their national currencies.

Pros and Cons of Ripple Blockchain

Pros:

- Speed- Transactions are processed in seconds

- Fees- Minimal Transaction Fee

- Scalability- Can handle a high volume of transactions per second

- Adoption- Wide adoption and valued for its credibility

Cons:

- Centralization Concerns– Criticized for being more centralized

- Regulatory issues– Lawsuit with U.S. SEC for selling XRP in an unregistered security offering

- Market volatility– XRP’s volatile nature brings risks for investors and institutions.

Also Read:- How Govt Uses Blockchain In the Electoral Process. Is it free and fair for elections?

Conclusion

Ripple’s continuous adoption and transformative innovation have been possible due to its exceptional speed, efficiency, and advantages over other digital currencies. Whether you are an investor, financial professional, or a curious person, blockchain holds a fascinating story to dive into. This field is yet to grow larger, and if you want to keep yourself updated with every trend and news following blockchain, you are at the right place. You can visit our blogs to keep yourself up to date with every upcoming trend in the blockchain industry.

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.

What is Ripple Blockchain? Everything You Need to Know in 2024?