AEPS App

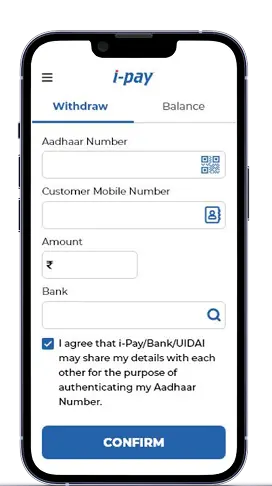

The AEPS App is an Android-based digital banking solution enabling secure financial transactions through Aadhar authentication. Using E-KYC and UID, it allows users to access Aadhar-linked bank accounts for cash withdrawals, balance checks, and fund transfers—ensuring interoperability, convenience, and cardless banking across institutions.

Country

United States of America

Service

Mobile App Development

Industry

Banking and Finance

Build your idea

About

The Project

The AEPS (Aadhar Enabled Payment System) App is an Android-based solution designed to promote financial inclusion and secure digital banking. Leveraging E-KYC and UID authentication, the app enables users to perform seamless transactions such as cash withdrawals, deposits, balance inquiries, and Aadhar-to-Aadhar fund transfers without relying on cards, OTPs, or ATM PINs. The client’s vision was to minimize bank frauds, ensure transparency, and empower both individuals and merchants with safe, cardless, and interoperable banking services. With features like biometric authentication, merchant management, and PoS support, the AEPS App bridges the gap between modern banking needs and secure digital innovation.

Process We Followed

After lining up salient details related to the project, our team outlined a course of action that would be followed to develop a comprehensive solution. The process comprised of identification of problems, considering the relevant factors of the solution, taking note of common challenges faced, technology stack to be used and coming up with the outcome in the end.

1. Problem Identification

The client aimed to boost financial inclusion and curb bank frauds with an AEPS app enabling secure Aadhaar-based C2B & C2G transactions, supporting government disbursements, multi-bank use, merchant management & cardless payments.

3. Solution Implementation

QSS conducted user research, discovery workshops, and competitor analysis to define AEPS features, tech stack, and UX. Using story mapping, the team shaped a secure, user-friendly banking app ensuring smooth transactions and market relevance.

2. Feasibility Study

The AEPS app was designed as a bank-led model with secure online authentication, enabling PoS/Micro ATM use, biometric cash withdrawals, fraud prevention, Aadhaar-linked transfers, instant balance checks & eliminating OTP/ATM pin reliance.

4. Challenges Faced by QSS

The AEPS app faced challenges like ensuring robust security, integrating biometric authentication, enabling inter-bank operations, simplifying account access, and designing an intuitive UI for seamless and secure user transactions.

5. Final Outcome Achieved

QSS Technosoft delivered a secure AEPS app with smooth UI/UX, one-tap authentication, inter-bank operability, and diverse payment services, empowering financial inclusion with easy cash withdrawals, deposits, and reliable digital transactions.

Problem Identification

The client approached us to alleviate the financial inclusion in the country and put a halt to several increasing bank frauds. Their idea was to bring an app into the marketplace that uses a person's Aadhar Card for performing any C2B and C2G transactions. With this initiative, the client wanted to empower users with secure payment services.

- Facilitates disbursements of Government entitlements.

- Interoperable across multiple banks.

- Backed with merchant management.

- Promotes cardless transactions.

Feasibility Study

While conversing with clients over the idea of the app, it seemed apparent that the client wants to lead a bank-led model that uses online authentication for financial transactions. However, we also realized that the client wants us to pay attention to facilitating PoS (Sales / Micro ATM) based transactions. Along with all the major details.

- Finger and IRIS detection for authentic cash withdrawal.

- Eliminates the threat of fraud and non-genuine activity.

- Transactions between Aadhaar linked bank accounts for security concerns.

- Immediate balance inquiry.

- Put an end to the use of OTP and ATM pins.

Solution Implementation

To ensure a structured approach, our team began by aligning the client’s vision with market demands and user expectations. We adopted a phased strategy that focused on research, discovery, and competitor insights to define a clear development roadmap.

User research

To understand the essence and need of the app in the marketplace, we surveyed some working groups and common people and tried to attain how to make financial transactions effective and secured through AEPS.

Product discovery workshop

In this mobile-driven world, every business is considering the mobile app for varied reasons. There is an application for every business now. Building a profitable mobile app that reigns the marketplace is not as easy as it seems. However, there are a few factors that make this arduous job just a cakewalk. Product discovery workshops are one of them. With the help of a discovery workshop, our development team formed a vision for a project requirement.

This well-organized discovery workshop not only helped our project development team in understanding the client's viewpoint but also made us realize the specific features, functionalities, and best-suited tech stack that could be considered in the AEPS app to help customers avail hassle-free regular banking services. With that said, our development team used a story mapping technique and split each element into easily comprehensible steps.

Competitor Analysis

The most essential way to stay relevant in the marketplace is to have an understanding of the competition and its best practices. The competitive analysis helped us gain a striking insight into the market around us.

Challenges Faced by Team QSS

Mobile app development has become something very common nowadays, however, like any other software development, mobile app development comes with its own set of issues and challenges. While constructing the AEPS app, our well-versed team of developers came across a few difficulties.

- Focusing on and implementing security structure.

- Add biometric support to the solution.

- Facilitating safe and secure payment option.

- Making it inter-operated across banks.

- Easy access to all bank accounts.

- Interactive UI with the easy-to-use process for individuals.

Final Outcome

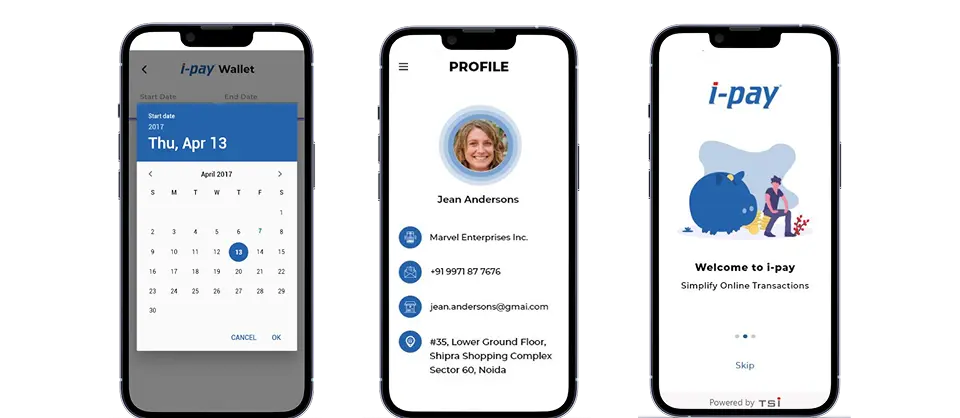

With the understanding of business requirements and the need for advanced digital payment systems, the team of QSS Technosoft presented the client with structured wireframes and process flow to carry out the procedure of making a secure and reliable payment solution.

- An interactive and smooth UI/UX Design.

- One-tap user registration and authentication.

- Interoperable across various banks.

- Encourages financial inclusion.

- Facilitates cash withdrawal and deposit.

- Diverse payment service configuration.

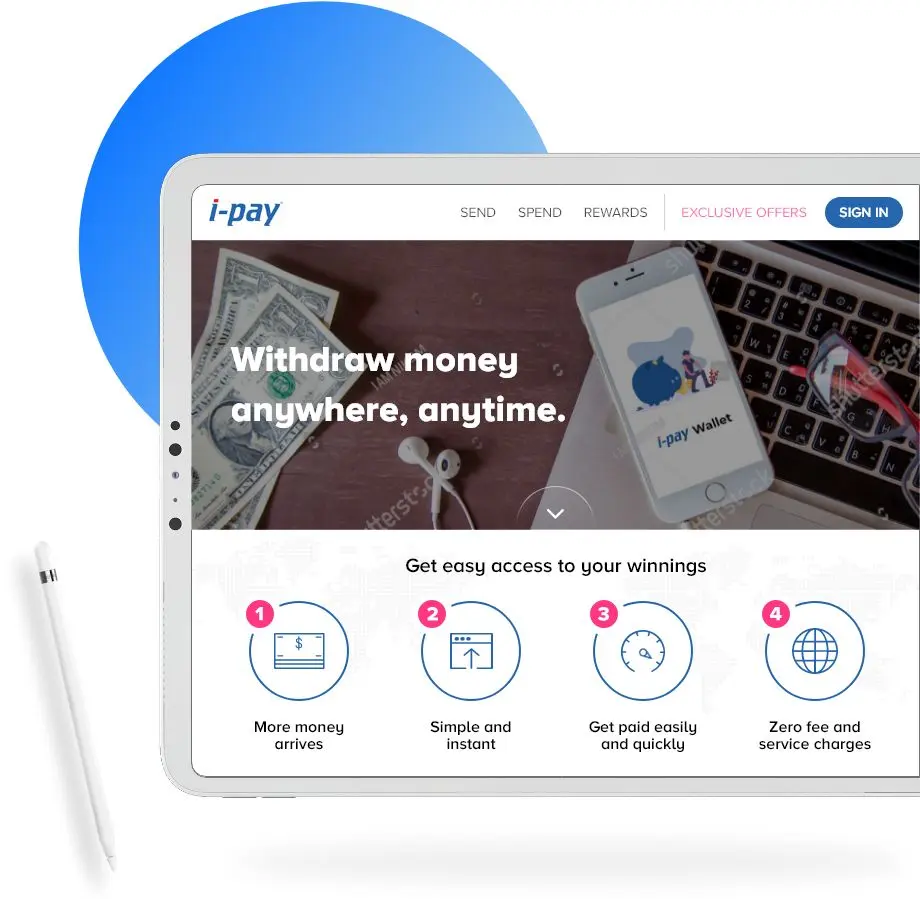

Our AEPS app enabled secure, cardless transactions, cutting fraud risks by 40% and driving 70% faster financial inclusion. Ready to revolutionize digital banking with QSS?

Sample Interview Questions

Yes, the client wants to lead a bank-led model that uses online authentication for financial transactions. We have also facilitated PoS (Sales / Micro ATM) based transactions.

GitLab, SQL Server, ASP.Net, Java, RD Services and C# are some tech stacks we have used.

Our development team used a story mapping technique and split each element into easily comprehensible steps.

- Finger and IRIS detection for authentic cash withdrawal

- An interactive and smooth UI/UX Design

- One-tap user registration and authentication

- Interoperable across various banks

- Encourages financial inclusion

- Facilitates cash withdrawal and deposit

- Diverse payment service configuration

Yes, the client was looking for a companion website too.

A workshop is conducted to help our project development team in understanding the client's viewpoint but also made us realize the specific features, functionalities and best-suited tech-stack that could be considered in the AEPS app to help customers avail hassle-free regular banking services.

Technology Stack

What Our client has to say!

" QSS team has adeptness in formulating new-age apps and driving them with cutting-edge technology. The team rolled through several techniques and constructed a productive app that caters to the need of young India for carrying out financial transactions."

Related case studies

Kickstart Your Dream Project with Us

We’ve helped industry leaders turn ideas into reality. Let’s build something extraordinary for you too.

Related Blogs

Check out our latest blogs here.