Table of Contents

- Summary

- Introduction

- Why Mobile Banking Apps Are Essential Today

- Increasing Customer Demand

- Benefits for Users

- Role of Technology

- Trends in Digital Banking

- Market Trend

- Understanding the Process Behind Mobile Banking Apps like Revoult

- The cost can primarily be broken down into two main components

- Key Features of a Mobile Banking App Like Revolut

- User Registration and Account Setup

- KYC Verification and Security Protocols

- Account Management and Transaction History

- Fund Transfers and Payments

- Push Notifications and Alerts

- Advanced Tools for Budgeting and Insights

- Customer Support and Chatbots

- Optional Advanced Features

- Quick and Easy Onboarding

- Advanced Security Features

- Importance of mobile banking apps like Revolut for businesses and companies

- Increased Accessibility

- Enhanced Security

- Cost Saving

- Streamlined Financial Management

- Improved Customer Service

- Factors affecting the cost of developing a mobile banking app like Revolut

- Platform Compatibility

- User Interface and User Experience (UI/UX)

- Security and Compliance

- Backend Infrastructure

- Features and Functionality

- Testing and Quality Assurance

- External Dependencies

- Agile Development Approach

- Breakdown of the cost to build a mobile banking app like Revolut

- The breakdown of the cost is as follows:

- Future Trends in Mobile Banking Apps

- AI and Machine Learning

- Biometric Authentication and Enhanced Security

- Integration with Digital Wallets and Fintech Platforms

- Blockchain for Secure and Transparent Transactions

- Examples of Popular Mobile Banking Apps

- How QSS Technosoft Can Help

- Conclusion

- FAQs Section

Summary

Developing a mobile banking app like Revolut involves significant investment but promises high returns due to rising demand for digital banking. Such apps enhance customer engagement, improve accessibility, and create new revenue streams through premium features. The development cost typically ranges from $30,000 to $300,000, depending on complexity, features, platform choice, and security compliance. Essential features include KYC verification, multi-currency support, fund transfers, budgeting tools, and advanced security protocols. Trends like AI, biometrics, blockchain, and fintech integrations are shaping the future of mobile banking apps. Partnering with an expert fintech app development company like QSS Technosoft ensures secure, scalable, and user-friendly solutions tailored to business needs.

Introduction

What is the price of developing a mobile banking app similar to Revolut? With the ongoing rise in popularity of mobile banking apps, this is a query that a variety of businesses and corporations are asking themselves.

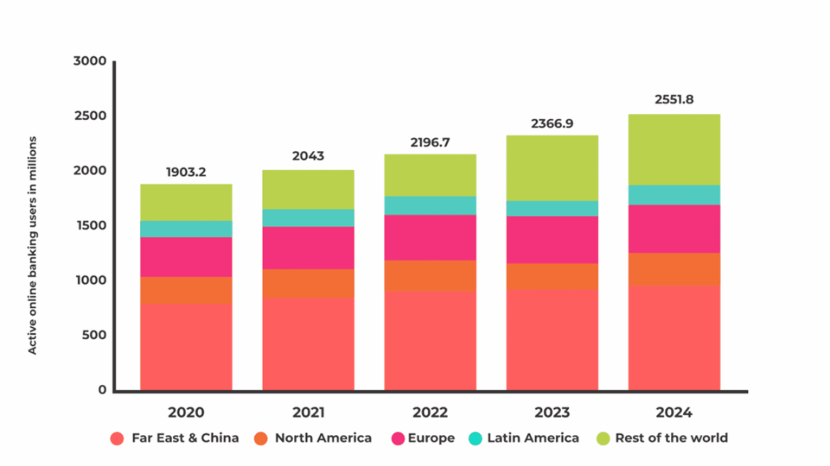

The use of online and mobile banking is expected to increase steadily between 2021 and 2024, with the Asian market being the largest. This figure is predicted to reach nearly one billion by 2024.

Given the ease and adaptability that mobile banking provides, it is understandable why an increasing number of individuals are choosing to manage their financial activities via smartphones.

We can say with a bit of luck that growing a mobile banking app can bring about substantial returns on funding, especially in relation to improved patron involvement and emblem loyalty. These apps' clean-to-use interfaces regularly bring about better customer delight and retention fees, in addition to the introduction of new profit streams like in-app purchases and top rate subscription plans.

QSS Technosoft is a trusted partner for building an app like Revoult ,secure and user-friendly mobile banking apps that meet the highest standards of performance and reliability.

Are you trying to find out how much it will cost to develop a Mobile banking app similar to Revolut? Then make sure to finish reading this blog post.

In this blog, we will discuss the various key factors influencing the impact of the cost of developing a mobile banking app, and break down the cost estimate for building an app like Revolut.

Why Mobile Banking Apps Are Essential Today

Increasing Customer Demand

Customers now expect 24/7 access to their financial information, demanding convenience and seamless management of their money anytime, anywhere. Mobile banking apps fulfill this by providing instant access to accounts and transactions. This shift has transformed how people interact with their finances, making mobile solutions indispensable.

Benefits for Users

Mobile banking apps enable instant transactions and often offer fee-free services, enhancing user satisfaction. They also provide personalized experiences through tailored notifications and budgeting tools. These features empower users to manage finances efficiently and with greater control.

Role of Technology

Advanced technologies such as APIs, artificial intelligence (AI), machine learning (ML), and cloud computing drive improvements in app efficiency and security. These innovations allow for real-time data processing, fraud detection, and scalable infrastructure. Together, they ensure mobile banking apps are reliable and safe for users.

Trends in Digital Banking

The rise of neobanks reflects growing user preference for fully digital banking solutions. Mobile banking adoption continues to increase globally, with more consumers choosing apps over traditional banks. This trend highlights the critical role mobile banking apps play in the future of financial services.

Market Trend

The neobank solutions market is expected to reach $394 billion by 2026, suggesting a CAGR of 46%+. The global mobile banking market is projected to exceed $7 billion by 2032, reflecting a CAGR of 16.8%. Revenue in the fintech sector was valued at $936 billion in 2023 and is projected to increase nearly threefold from 2023 to 2028. Revolut has a user base of over 40 million as of 2023 and has significantly advanced its cryptocurrency services. Revolut's annual revenue exceeded £1.8 billion in 2023, indicating significant growth in the company and the expanding digital banking landscape across various target markets.

Empower Your Digital Vision with an Award-Winning Tech Partner

QSS Technosoft is globally recognized for innovation, excellence, and trusted delivery.

- Clutch Leader in App Development 2019

- Ranked Among Top 100 Global IT Companies

- Honored for Cutting-edge AI & Mobility Solutions

Understanding the Process Behind Mobile Banking Apps like Revoult

Before understanding the process behind the mobile banking app, let's first understand about Revolut banking app.

Revolut is one such popular mobile banking app that has captured the attention of users worldwide. It offers a wide range of features such as foreign currency exchange, budgeting tools, and even cryptocurrency transactions. Businesses and companies looking to create a similar app may be wondering about the financial implications of such a venture, especially regarding integration with financial institutions and regulatory compliance.

Building a mobile banking application is a complex process that requires a multidisciplinary team of professionals, including designers, developers, and quality assurance engineers. The process usually involves four stages – ideation, design, development, and testing in digital banking.

The cost can primarily be broken down into two main components

Development and ongoing maintenance.

The development phase encompasses activities such as designing the user interface, implementing the necessary security measures, integrating payment gateways, and building the back-end infrastructure.

The ongoing maintenance phase includes bug fixes, updates, security enhancements, and server maintenance.

In the ideation stage, the team looks to define the goals and objectives of the app, identify the target audience, and create a list of features and specifications that the app should have.

The design stage involves creating wireframes, prototypes, and user interfaces that represent the app's functionalities and features. The development stage is where the app is built and coded, followed by quality assurance testing to identify and fix any bugs or issues.Ongoing maintenance costs for the app can add an additional expense of 10-20% of the initial development cost annually.

Read Our Page: Complete Guide to Mobile App Development in 2023

Key Features of a Mobile Banking App Like Revolut

User Registration and Account Setup

A seamless user registration process is essential for onboarding new customers quickly and efficiently. Users can create accounts with a few clicks, providing basic personal information. The setup process should be intuitive, enabling users to start managing their finances without delay.

KYC Verification and Security Protocols

Implementing Know Your Customer (KYC) verification is crucial for regulatory compliance and fraud prevention. The revolut app must securely collect and verify user identity documents. Robust security protocols, including biometric authentication and data encryption, apps handle sensitive financial data.Revolut has user management tools for administrators to handle account verification and suspicious account blocking.

Account Management and Transaction History

Users should have full control over their accounts, including viewing balances and managing personal details. A detailed transaction history allows users to track spending and deposits easily. This transparency enhances trust and helps users maintain financial oversight.Users can exchange currencies at real-time rates, enabling them to spend or transfer money internationally without incurring high fees.

Fund Transfers and Payments

The app must support quick and secure fund transfers both domestically and internationally. Users can send money to other accounts or pay bills conveniently. Integration with various payment gateways ensures smooth processing and real-time transaction updates.Revolut allows users to send money abroad using recipient IDs such as names, phone numbers, or email addresses.

Push Notifications and Alerts

Real-time push notifications keep users informed about account activity, payment confirmations, and suspicious transactions. Customizable alerts help users stay on top of their finances and enhance security. This feature improves user engagement and trust.

Advanced Tools for Budgeting and Insights

Budgeting tools assist users in managing their expenses by categorizing spending and setting limits. Insightful analytics provide personalized financial advice and spending patterns. These features empower users to make informed financial decisions.

Customer Support and Chatbots

Integrated customer support tools offer users quick assistance for common issues. AI-powered chatbots provide 24/7 help, answering queries and guiding users through app functions. Efficient support enhances user satisfaction and retention.

Optional Advanced Features

Additional features like AI-driven recommendations personalize the user experience by suggesting savings or investment options. Card control options allow users to manage spending limits and freeze cards instantly. Multi-currency support enables seamless international transactions for global users.

Quick and Easy Onboarding

Quick and easy onboarding ensures users can create accounts effortlessly within minutes. The process is streamlined with minimal steps and intuitive guidance. This enhances user satisfaction and accelerates app adoption.Users can open an account in minutes using the Revolut app.

Advanced Security Features

Mobile banking apps like Revolut incorporate advanced security features to protect users' sensitive financial data. These include multi-factor authentication, biometric authentication (such as fingerprint and facial recognition), and end-to-end data encryption. Additionally, real-time fraud detection and transaction monitoring systems help prevent unauthorized access and fraudulent activities. Revolut integrates robust security features such as two-factor authentication and biometric authentication to safeguard users' accounts. Transaction monitoring is a crucial admin feature to identify fraudulent activities or suspicious behavior. When you develop an app like Revolut, incorporating these advanced security protocols is essential to ensure user trust and regulatory compliance.

Importance of mobile banking apps like Revolut for businesses and companies

Mobile banking apps like Revoult have become increasingly important for businesses and companies. With more and more people using their smartphones to manage their finances, companies that offer mobile banking apps have a competitive edge over those that don't.

Here, we will explore the importance of mobile banking apps to illustrate each point.

Increased Accessibility

Revolut Mobile banking apps allow businesses to access their financial information and perform transactions at any time and from anywhere. They provide real-time updates on account balances, transaction history, and allow businesses to make payments or transfers instantly. For example, Chase's mobile banking app enables businesses to manage their finances on the go.

Enhanced Security

Mobile banking apps employ advanced security measures to protect sensitive financial information. Many apps incorporate features like biometric authentication, such as fingerprint or facial recognition, to ensure only authorized individuals can access the app. For instance, Barclays' mobile banking app offers biometric security for its users.

Cost Saving

Mobile banking apps eliminate the need for businesses to physically visit a bank branch, saving both time and money. Businesses can receive and process payments, pay bills, and send invoices using their mobile banking apps, thereby reducing administrative costs. An example is QuickBooks' mobile app, which allows businesses to manage their finances and track expenses on the go.

Streamlined Financial Management

Mobile banking apps offer a variety of tools and functionalities that assist businesses in effectively managing their finances. They provide insights into cash flow, allow businesses to categorize transactions for accurate record-keeping, and generate comprehensive financial reports. A real example is Xero's mobile app, designed specifically for small businesses to streamline their financial management.

Improved Customer Service

Mobile banking apps enable businesses to provide better customer service by offering self-service options. Businesses can respond to customer inquiries, provide real-time support, and track and resolve any issues efficiently through the app. For instance, Bank of America's mobile banking app has a chatbot feature that assists customers with their queries.

Read Also: How Much Does it Cost to Build a React Native Based App? – QSS

Factors affecting the cost of developing a mobile banking app like Revolut

The cost to develop an app like Revolut can vary based on factors such as app complexity, design specifications, and the development team's location.Developing a mobile banking app, Revolut, involves various factors affecting development costs that can significantly affect the overall expense. Here are some key factors to consider:

Platform Compatibility

Native vs. cross-platform development: Developing a mobile banking app specifically for a single operating system, such as iOS or Android, may require less effort and cost compared to cross-platform development.

Supporting older versions: If the app needs to support older versions of operating systems, it will require additional development and testing efforts.

User Interface and User Experience (UI/UX)

Complexity of the design: A complex and visually appealing UI/UX design with custom animations, transitions, and gestures will require a longer development time and, subsequently, more cost.The design requirements for a mobile banking app influence development costs, as investing in intuitive UI/UX design can augment overall expenses.

Accessibility features: Implementing accessibility features for users with disabilities may increase development efforts and costs.

Security and Compliance

Encryption standards: Developing a secure mobile banking app involves implementing modern encryption standards, strengthening data protection, and complying with industry regulations (e.g., Payment Card Industry Data Security Standard). Complying with these requirements can increase the development cost.

Authentication and biometrics: Integrating features like fingerprint or face recognition adds an extra layer of security but may increase development time and cost.

Backend Infrastructure

Server architecture: The complexity of designing and implementing the server infrastructure plays a crucial role in the overall cost of developing a mobile banking app.

API integrations: Integrating with third-party APIs for features like payment gateways, credit score services, or location tracking can increase development costs due to additional coding and testing efforts.

Features and Functionality

Transaction capabilities: The more complex and extensive the transaction capabilities (e.g., fund transfers, bill payments, international remittances), the more time and resources are needed for development and testing.

Push notifications and alerts: Implementing real-time notifications and alerts increases user engagement but requires additional development efforts and backend support.

Testing and Quality Assurance

Device compatibility testing: Thorough testing on multiple devices, screen sizes, and operating systems can increase the time and cost associated with development.

Security testing: Rigorous security testing to identify vulnerabilities or weaknesses can increase the overall cost of app development.

External Dependencies

Integrations with existing banking systems: If the mobile banking app needs to integrate with legacy banking systems, it may require additional time and resources for understanding and adapting to these systems.

Regulatory requirements: Compliance with financial regulations in different regions or countries may require additional customization and legal consultation, which can increase development costs.

Agile Development Approach

Iterations and change requests: Adopting an agile development approach involves accommodating change requests and iterations, which may increase the development timeline and cost.

Read Also: What Does it Cost to Build a Business Networking App like LinkedIn?

Breakdown of the cost to build a mobile banking app like Revolut

Now that we understand the factors that influence the cost of developing a mobile banking app, let's break down the cost to build an app like Revolut.

The cost to develop a mobile banking app like Revolut usually falls within the range of $30,000 to $250,000. This cost estimate covers all the stages of app development, from ideation to launch.The average cost to develop an app like Revolut typically falls within the range of $30,000 to $300,000.

The breakdown of the cost is as follows:

- Planning and ideation stage: This stage involves defining the project goals and objectives, identifying the target audience, creating a list of features and specifications, and developing a project schedule. This stage typically costs between $5,000 $15,000. Initial steps of developing a FinTech app include defining goals and identifying essential features based on market research and user needs. When you decide to develop an app like Revolut, careful planning at this stage is crucial to set a strong foundation for the project.

- Design stage: In this stage, the team designs the app's user interface, wireframes, and prototypes. This stage costs between $10,000 $25,000. When you develop an app like Revolut, investing in a well-thought-out UI/UX design is crucial to ensure an intuitive and engaging user experience.

- Development stage: This stage is where the app's backend and frontend are coded. This stage usually costs between $15,000 $150,000, depending on the app's complexity and functionalities. When you develop an app like Revolut, this phase requires careful attention to both frontend and backend development to ensure seamless performance and user experience.

- Quality assurance testing: This stage is where the app is tested for performance, functionality, and usability. This stage typically costs between $5,000 $25,000.

- Launch and maintenance: This stage involves deploying the app and providing ongoing maintenance and support. This stage typically costs between $5,000 $25,000, depending on the level of support required.

Development Stage

Basic Mid-Level, Advanced App

Stage Basiccovery and Planning

$3k-$7k

$7k-$15k

$15k-$25k

UI/UX Design

$5k-$10k

$10k-$20k

$20k-$40k

Backend and Frontend Dev

$20k-$50k

$50k-$100k

$100k-$200k

Testing and QA

$5k-$10k

$10k-$20k

$20k-$40k

Deployment and Launch

$1k-$3k

$3k-$5k

$5k-$10k

Maintenance and Support

$5k-$10k/yr

$10k-$20k/yr

$20k-$40k/yr

Future Trends in Mobile Banking Apps

AI and Machine Learning

AI and machine learning are transforming mobile banking by providing personalized financial insights and predictive analytics. These technologies help users make smarter decisions by analyzing spending patterns and forecasting future expenses. Banks can also leverage AI to offer tailored product recommendations and improve customer engagement.

Biometric Authentication and Enhanced Security

Biometric authentication methods such as fingerprint scanning and facial recognition are becoming standard in mobile banking apps like Revolut. These features enhance security by ensuring that only authorized users can access sensitive financial data. Combined with multi-factor authentication and other robust security measures, biometrics help prevent fraud and unauthorized transactions.

Integration with Digital Wallets and Fintech Platforms

Mobile banking apps are increasingly integrating with popular digital wallets and fintech platforms to offer seamless payment experiences. This integration allows users to manage multiple financial services within a single app, simplifying transactions volume and improving convenience. It also opens opportunities for innovative service offerings and partnerships.

Blockchain for Secure and Transparent Transactions

Blockchain technology is being adopted to enhance transaction security and transparency in mobile banking. It provides a decentralized ledger that makes fraud and tampering nearly impossible. Blockchain also enables faster cross-border payments and supports emerging features like cryptocurrency management within banking apps.

Examples of Popular Mobile Banking Apps

Several mobile banking apps have gained widespread popularity for their innovative features and user-friendly interfaces. Here are some notable examples:

- Revolut: A leading neobank offering multi-currency accounts, international transfers, cryptocurrency trading, budgeting tools, and advanced security features.

- Monzo: A UK-based digital bank known for its intuitive app design, instant notifications, budgeting features, and fee-free spending abroad.

- N26: A European mobile bank providing real-time account management, international payments, and seamless integration with various fintech services.

- Chime: A US-based challenger bank focusing on no-fee accounts, early direct deposit, automatic savings, and user-friendly mobile banking.

- Varo: Another US digital bank offering no monthly fees, high-yield savings accounts, and tools to help users manage their finances effectively.

These apps exemplify the growing trend toward digital banking platforms that prioritize convenience, security, and innovative financial management tools.

How QSS Technosoft Can Help

- Expertise in Secure, Scalable Development: Delivering robust mobile banking apps that prioritize security and performance.

- Customized Solutions: Tailoring app features and design to meet your specific business needs and goals.

- Compliance Focus: Ensuring adherence to industry regulations and standards for safe financial operations.

- Seamless User Experience: Crafting intuitive and engaging interfaces for effortless customer interaction.

- Advanced Feature Integration: Incorporating cutting-edge functionalities like biometric authentication and real-time analytics.

Conclusion

Developing a mobile banking app like Revolut is not an easy task. It requires a team of highly skilled professionals who can navigate through the complex and ever-changing world of finance and technology. From designing intuitive user interfaces to implementing top-notch security measures, every aspect needs to be carefully considered when estimating the cost to develop such an app.

But hey, quality comes at a price, and we're not talking about just any banking app here. We're talking about a powerful, feature-rich, and user-friendly app that can revolutionize the way people manage their finances.

But who should you entrust with such a monumental task? Look no further than QSS Technosoft!

We come at the top when it comes to mobile app development. With our expertise and experience in the financial technology domain, we will surely leave no stone unturned in creating the best mobile banking app that will make your competitors green with envy.

So, why should you invest in a mobile banking app? Well, besides the obvious benefits of staying ahead of the curve and attracting new customers, it opens up a world of possibilities for your business. Imagine providing your existing customers with a seamless and convenient way to manage their finances on the go. It's like having a personal banker in their pocket! So, what are you waiting for? It's time to take your business to new heights with a mobile banking app that will make waves in the industry.

Contact us today. Partnering with QSS Technosoft ensures high-quality, secure, and user-friendly mobile banking solutions.

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.

FAQs Section

Q1: How much does it cost to build a mobile banking app like Revolut?

The estimated cost to build a mobile banking app like Revolut typically ranges from $30,000 to $250,000. This depends on factors affecting like app development costs, such as app complexity, platform choice, design requirements, security features, and third-party integrations.

Q2: What are the must-have features for a fintech app like Revolut?

Key features include multi-currency accounts, account management, fund transfers and payments, KYC (Know Your Customer) verification, biometric authentication, budgeting tools, real-time notifications, and robust security measures to handle sensitive financial data securely.

Q3: What development process is involved in building an app like Revolut?

The development process involves market research, planning and ideation, UI/UX design, backend development, integration of third-party services, quality assurance testing, launch, and ongoing maintenance with compliance monitoring.

Q4: How important is compliance with regulations like GDPR and KYC in fintech app development?

Compliance is critical to ensure secure transactions, protect user data, and meet legal requirements. Integrating KYC and AML (Anti-Money Laundering) procedures helps verify user identities and monitor transactions to prevent fraud.

Q5: Can a web app complement a mobile banking app like Revolut?

Yes, a web app provides users with additional accessibility and convenience, allowing them to access their accounts and perform transactions from desktop browsers, expanding the reach beyond mobile platforms.

Q6: What role do third-party integrations and open banking APIs play in app development?

Third-party integrations enable essential functionalities like payment processing, data aggregation, and identity verification. Open banking APIs facilitate secure connections with financial institutions, enhancing the app’s capabilities and user experience.

Q7: How can cost-cutting tips be applied during a revolut-like app development?

Starting with core features, outsourcing to experienced development teams in cost-effective regions, using cross-platform frameworks like Flutter or React Native, and leveraging existing fintech platforms can help reduce the total cost without compromising quality.

Q8: Who should be part of the development team for creating a fintech app like Revolut?

A skilled development team typically includes UI/UX designers, frontend and backend developers, security experts, compliance officers, and quality assurance testers to ensure a secure, user-friendly, and compliant app.

Q9: How does the fintech market influence the demand for apps like Revolut?

The growing fintech market, driven by increasing digital banking adoption and user preference for convenient financial management, creates high demand for innovative apps like Revolut that offer seamless and secure services.

Q10: How long does it take to develop a mobile banking app like Revolut?

Development time varies based on app complexity and features but generally ranges from several months to over a year, including planning, design, development, testing, and launch phases.

How much does it cost to build a mobile banking apps like Revolut?