Table of Contents

- Summary

- Introduction

- Understanding Mobile Banking App like First Direct

- Core Features of a Mobile Banking App like First Direct

- Basic Features

- Advanced Features

- What Are the Advantages of Mobile Banking App like First Direct

- Convenience

- Enhanced Security

- Real-Time Notifications

- Access to Account Information

- Seamless Integration

- Personalization

- Quick and Easy Transactions

- Customer Support

- Tech Stack Required for Building a Mobile Banking App

- Frontend

- Backend

- Database

- Security

- Cloud Services

- What Are the Factors Affecting the Cost to Build a Mobile Banking App Like First Direct

- Platform Compatibility

- Design and User Experience

- Features and Functionality

- Security and Compliance

- Integration

- Maintenance and Support

- Development Team Location and Hiring Model

- Infrastructure and Hosting Costs

- Cost Breakdown to Build a Mobile Banking App like First Direct

- Development Team

- Technology Stack

- Security Measures

- Third-Party Integrations

- Infrastructure Costs

- Estimated Cost to Build a Mobile Banking App like First Direct

- Basic Version

- Mid-level App

- Advanced Banking Solution

- Mobile Banking App Cost Breakdown Table

- Timeline for Development

- The Process Behind Building a Mobile Banking App Like First Direct

- Requirement Gathering

- Designing UI/UX

- Back-end Development

- Security Implementation

- API Development

- Testing

- Deployment

- Ongoing Maintenance and Updates

- Why Choose QSS Technosoft for Mobile Banking App Development?

- Conclusion

- FAQs Section

Summary

Mobile banking apps like First Direct are in high demand due to their convenience, security, and advanced features. Core functionalities include account management, fund transfers, bill payments, AI chatbots, and CRM integration. Development costs range from $40,000 for basic to $120,000+ for advanced solutions, influenced by features, tech stack, security, and team location.

Ongoing maintenance typically costs 15–20% of the initial budget annually, plus infrastructure and hosting expenses. Planning, UX design, and robust security implementations are critical investments that impact both cost and app success.QSS Technosoft offers end-to-end mobile banking app development with secure, scalable, and cost-effective solutions tailored to your needs.

Introduction

Is it Worth Investing in Developing a Mobile Banking App Like First Direct?

Have you ever considered how our everyday financial habits are affected by mobile banking apps? Surprisingly, a recent Statista analysis indicates that over 85% of consumers in the UK utilized online banking services in 2020, demonstrating the growing trend toward digital financial management.

First Direct, with its consumer-centric approach and modern generation, has set a benchmark in the enterprise. This may additionally appear like frightening financial funding, but the returns are substantial. For instance, the First Direct cellular banking app has over 10,000 positive reviews on the App Store, with a median rating of 4.8 out of 5.

This demonstrates the high demand and delight of customers, indicating that making an investment in a mobile banking app may have a superb effect on the growth and success of organizations.

Many startups and established banks and financial institutions aspire to emulate its success, but the main concern that arises is the cost and investment required to develop a mobile banking app that matches the standards set by First Direct achieving a competitive edge in the rapidly evolving fintech landscape.

First Direct stands as a benchmark for secure and innovative digital banking, setting high standards with its cutting-edge technology and robust security protocols. Its mobile banking app exemplifies how modern financial institutions can combine user-friendly design with enhanced security measures to deliver a trusted banking experience.

Hold on! In this blog, we are going to provide a comprehensive guide on the cost to develop a mobile banking app like First Direct. Discuss how QSS Technosoft can assist you in building a secure, feature-rich mobile banking solution tailored to your needs. So, make sure to read this till the end

Read Our Page: Complete Guide to Mobile App Development in 2023

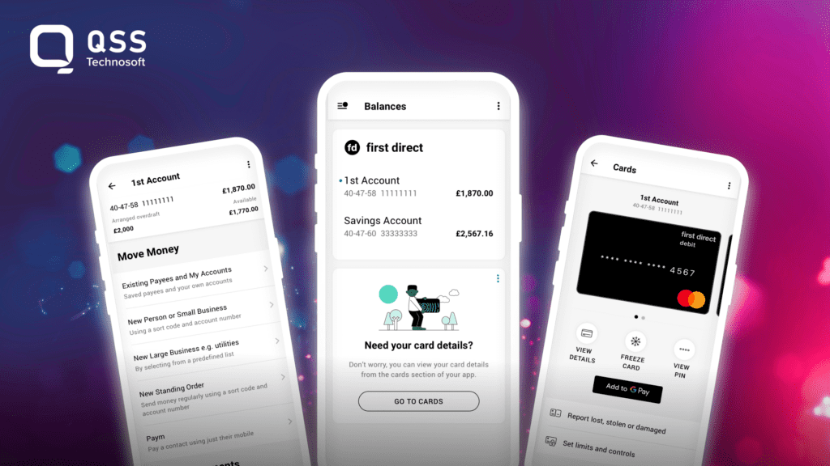

Understanding Mobile Banking App like First Direct

First Direct's mobile banking app development offers users interfaces a seamless banking experience with app features like account management, real-time transaction updates, bill payments, fund transfers, expense tracking, and personalized financial insights. The app's intuitive design and user-friendly interface allow customers to easily navigate through various software development services while ensuring data privacy and security through advanced encryption and authentication protocols.

An example of the First Direct app's functionality could be a customer using the app to make a peer-to-peer transfer to a friend. The customer enters the recipient's contact details, the amount to be transferred, and then verifies the transaction using biometric authentication such as fingerprint or facial recognition. The funds are instantly transferred between accounts, with both parties receiving real-time notifications of the transaction

Core Features of a Mobile Banking App like First Direct

Basic Features

User Registration and Login

Secure and easy onboarding with biometric authentication and two-factor authentication to protect user data and accounts.

Account Management

Allows users to view and manage multiple accounts seamlessly within the app.

Balance and Transaction History

Provides real-time access to account balances and detailed transaction records for transparency.

Fund Transfers and Bill Payments

Enables quick and secure peer-to-peer transfers and bill payments directly from the mobile device.

Push Notifications

Keeps users informed with instant alerts on transactions, payments, and account activities.

Advanced Features

AI-powered Chatbots

Offers personalized, 24/7 customer support using artificial intelligence to resolve queries efficiently.

Budget Tracking and Financial Analytics

Helps users monitor spending habits and provides insights to improve financial health.

Card Management

Gives users control to temporarily freeze or unfreeze their cards for enhanced security.

Multi-currency Support

Facilitates transactions in various currencies, ideal for international users and travelers.

Personal Loan/Investment Modules

Integrates loan application and investment management tools for comprehensive financial services.

CRM Integration

Integration with customer relationship management systems can help mobile banking apps provide automated support and instant responses, improving customer satisfaction and retention.

What Are the Advantages of Mobile Banking App like First Direct

Known for its innovative key features and seamless functionality, First Direct offers numerous advantages over traditional banking methods. Let's take a look at the top benefits of mobile banking app like First Direct.

Convenience

First Direct's mobile banking app enables users to perform a wide range of banking transactions at their convenience, anytime and anywhere. For instance, customers can effortlessly transfer funds between accounts, pay bills, and even deposit checks by simply snapping a photo using their smartphones or tablets.

Example:The mobile banking app utilizes secure APIs to connect seamlessly with the bank's core banking system, enabling real-time transaction processing and access to account information.

Enhanced Security

First Direct prioritizes the security of its mobile banking app users. The app incorporates advanced security measures such as biometric authentication (fingerprint or facial recognition), multi-factor authentication, and end-to-end encryption protocols. These measures ensure that users' personal and financial data remain protected from unauthorized access and fraudulent activities.

Example: The app employs secure authentication protocols such as OAuth 2.0 and OpenID Connect to establish secure communication channels with the bank's servers, preventing unauthorized entities from intercepting or tampering with sensitive data.

Real-Time Notifications

Through push notifications, First Direct's mobile banking app keeps users informed about every transaction activity happening in their accounts. Users receive immediate alerts on their mobile devices for various activities, including card transactions, fund transfers, and bill payments.

Example :The app uses a combination of server-side event-driven architecture and WebSocket protocol to deliver real-time transaction notifications, ensuring that users receive updates promptly and efficiently.

Access to Account Information

First Direct's mobile banking app empowers users with comprehensive access to their account details. Users can easily check their account balances, review transaction history, and retrieve e-statements, all from within the app.

Example: The app uses APIs and secure connections to retrieve real-time data from the bank's or financial institutions central database, ensuring that users have up-to-date and accurate account information at their fingertips.

Seamless Integration

First Direct's mobile banking app seamlessly integrates with various financial tools and services. This integration provides users with a holistic view of their financial health by allowing them to connect their banking app with external platforms such as budgeting tools, investment apps, and personal finance management applications.

Example: The app employs industry-standard API integration techniques, utilizing RESTful APIs or SDKs provided by partner services to establish secure and authenticated connections, allowing the exchange of financial data with external platforms.

Personalization

First Direct's mobile banking app offers personalized features and functionalities tailored to individual users. For example, the app allows users to set spending limits, create savings goals, and receive personalized financial tips and recommendations based on their spending patterns and transaction history.

Example: This uses machine learning algorithms and data analytics techniques to analyze user data, generating personalized insights and recommendations that assist users in achieving their financial goals.

Quick and Easy Transactions

First Direct's mobile banking app streamlines transactions, making them quick and easy for users. Features like quick pay, peer-to-peer payments, and contactless payments enable users to make instant and secure transactions from their mobile devices.

Example: They integrate with secure payment gateways and utilize tokenization to ensure the advanced security features of payment transactions, enabling seamless and secure processing of mobile payments.

Customer Support

First Direct's mobile banking app offers seamless customer support features, allowing users to seek assistance within the app itself. In-app chat, email, and phone call functionalities enable users to connect with customer service representatives to resolve queries or address any issues they encounter.

Example: They integrate with customer relationship management systems and chatbot platforms, utilizing natural language processing and artificial intelligence to provide automated support and instant responses to customer queries.

Also Read : How Much Does it Cost to Build React Native Based App? – QSS

Empower Your Digital Vision with an Award-Winning Tech Partner

QSS Technosoft is globally recognized for innovation, excellence, and trusted delivery.

- Clutch Leader in App Development 2019

- Ranked Among Top 100 Global IT Companies

- Honored for Cutting-edge AI & Mobility Solutions

Tech Stack Required for Building a Mobile Banking App

Frontend

React Native and Flutter are popular frameworks for building cross-platform mobile applications, enabling seamless user experiences on both iOS and Android devices.

Backend

Node.js, Java, and .NET are robust backend technologies that handle business logic, data processing, and integration with banking systems efficiently.

Database

MySQL, PostgreSQL, and MongoDB offer reliable and scalable data storage solutions tailored to the app’s specific requirements and data structures.

Security

Implementing AES-256 encryption, SSL protocols, and adhering to PCI DSS compliance ensures the protection of sensitive financial data and secure transactions.

Cloud Services

AWS and Azure provide scalable cloud infrastructure and services that support app hosting, data storage, and continuous deployment with high availability.

What Are the Factors Affecting the Cost to Build a Mobile Banking App Like First Direct

When it comes to building a mobile banking app like First Direct, there are several key factors that can influence the overall cost. These key factors can vary depending on the complexity of the app and the specific requirements of the client.

Platform Compatibility

The cost of building a mobile banking app can be affected by the number of platforms it needs to be compatible with. Developing an app for both iOS and Android can require more resources, which can increase the cost.

Design and User Experience

The complexity and quality of the app's design and user experience can impact the app development cost. Creating an intuitive user interface and ensuring a seamless user experience often require additional time and expertise, which can increase the overall cost of development. Investing in user experience (UX) design is crucial and can consume 10-15% of the total project budget.

Features and Functionality

The range of features and functionalities required in the app can significantly affect the app development cost. Implementing features such as balance inquiries, transaction history, fund transfers, bill payments, and card management can increase the complexity of the app. On top of that, if features like biometric authentication or integration with third-party services are needed, it can further add to the cost.

Security and Compliance

Building a secure mobile banking app requires robust security measures to protect customer data and transactions. Implementing encryption, secure APIs, and complying with data protection financial regulations can contribute to the app development cost. Security testing and auditing may also be necessary, which can increase the overall development cost.Security implementations in mobile banking apps typically range from $10,000 to over $100,000 depending on complexity.Security implementations in mobile banking apps typically range from $10,000 to over $100,000 depending on complexity.

Integration

If the app needs to integrate with existing banking systems or third-party services, it can complicate the development process. Integrating with payment gateways, core banking systems, or other financial institutions can require additional effort and increase the overall cost.

Maintenance and Support

After the initial development, mobile banking apps require ongoing maintenance and support. This can include bug fixes, updates for new operating systems, security patches, and feature enhancements. The app development cost of long-term maintenance and support should also be considered when evaluating the overall cost of building a mobile banking app.

Development Team Location and Hiring Model

The cost of building a mobile banking app can vary widely based on where your development team is located. In-house development teams generally cost significantly more than outsourcing to other regions due to higher hourly rates, while outsourcing to experienced partners in cost-effective locations can deliver the same quality assurance at a fraction of the cost.

Infrastructure and Hosting Costs

Mobile banking apps require reliable hosting, robust server maintenance, and scalable cloud services to handle sensitive financial transactions securely. Infrastructure costs for hosting, server maintenance, and cloud services contribute to ongoing operational expenses for fintech applications and must be factored into the long-term budget.

Read Also : What Does it Cost to Build a Business Networking App like LinkedIn?

Cost Breakdown to Build a Mobile Banking App like First Direct

The estimated app development cost to build a mobile banking app like First Direct can range from $100,000 to $500,000 or more, depending on the aforementioned factors. Here is a breakdown of the costs involved:

Development Team

Hiring developers, designers, testers, and project managers is the most significant cost component.

Technology Stack

Costs associated with selecting the appropriate technologies, tools, and frameworks for fintech app development.

Security Measures

Investing in encryption, authentication, and security protocols to protect user data and transactions

Third-Party Integrations

Fees related to integrating with payment gateways, banking systems, and other external services.

Infrastructure Costs

Hosting, server maintenance, and cloud services add to the ongoing operational expenses.

Estimated Cost to Build a Mobile Banking App like First Direct

Basic Version

This version costs $40,000 – $60,000 includes essential features such as user registration, account management, balance inquiries, and basic fund transfers. Costs may vary depending on the location and expertise of the development team. QSS Technosoft provides cost-effective solutions without compromising on quality and security.

Mid-level App

A mid-level app offers additional functionalities like budgeting tools, push notifications, and enhanced advanced security features, and costs $70,000 – $100,000. Development costs fluctuate based on team location and experience. QSS Technosoft combines skilled expertise with affordable pricing to deliver reliable fintech apps.

Advanced Banking Solution

Advanced apps incorporate complex features such as AI-powered chatbots, multi-currency support, and personalized financial insights, which cost $120,000+.The overall cost depends on the development team's proficiency and geographical factors.

Note: These are only estimates, and actual costs to develop an app like First Direct may vary based on factors like development team rates, project complexity, and specific features required. Additionally, ongoing maintenance costs are not included in these breakdowns. The ongoing maintenance costs for mobile banking apps typically amount to 15-20% of the initial development cost annually. For proper quotes, contact the QSS Technosoft team. QSS Technosoft ensures high-quality, scalable solutions tailored to your business needs, helping you manage the overall app development cost effectively.

Mobile Banking App Cost Breakdown Table

Below is a detailed cost breakdown for building different levels of mobile banking apps—Basic banking app , Intermediate, and Advanced—along with their key components. This tabular overview helps you understand how features and complexity impact the overall fintech app development cost.

App Level | Estimated Cost Range | Key Components and Features |

|---|---|---|

Basic Mobile Banking App | $40,000 – $60,000 | - User Registration and Login (including biometric authentication) |

- Account Management (view balances, multiple accounts) | ||

- Balance and Transaction History | ||

- Fund Transfers and Bill Payments | ||

- Basic Security Measures (encryption, secure login) | ||

- Push Notifications | ||

- Integration with core banking system | ||

Intermediate Mobile Banking App | $70,000 – $100,000 | - All Basic Features |

- Budgeting Tools and Expense Tracking | ||

- Enhanced Security Features (multi-factor authentication, tokenization) | ||

- AI-powered Chatbots for customer support | ||

- Card Management (freeze/unfreeze cards) | ||

- Real-time Transaction Updates | ||

- Integration with third-party financial services | ||

Advanced Mobile Banking App | $120,000+ | - All Intermediate Features |

- Multi-currency Support | ||

- Personal Loan and Investment Management Modules | ||

- Advanced Financial Analytics and Personalized Insights | ||

- Advanced Security Measures (end-to-end encryption, continuous monitoring, regular security audits) | ||

- Seamless Integration with external budgeting, investment, and payment platforms | ||

- Comprehensive Customer Support (in-app chat, AI-driven assistance) |

Note:Actual costs may vary based on development team rates, complex apps, technology stack, and geographic location. Ongoing maintenance and compliance costs are additional considerations that influence much does it cost to develop a mobile banking app like First Direct.

Timeline for Development

- Planning and Research: Planning and research typically represent only 10-15% of your total budget but can deliver substantial returns by reducing mid-development changes, typically taking 2–4 weeks.

- UI/UX Design: This phase involves creating wireframes, prototypes, and final designs to ensure an intuitive and user-friendly interface, typically taking 4–6 weeks.

- Development: The core coding and building of app functionalities occur during this stage, lasting approximately 3–6 months, depending on complexity.

- Testing and Quality Assurance: Rigorous penetration testing is conducted to identify and fix bugs, verify performance, and ensure basic security, usually spanning 4–6 weeks.

- Deployment and Launch: Final preparations, server configuration, and app store submissions happen here, taking about 1–2 weeks before the app goes live.

The Process Behind Building a Mobile Banking App Like First Direct

Building a mobile banking app like First Direct involves a structured process that includes the following technical bullet points:

Requirement Gathering

- Identify and gather requirements for the app's functionalities.

- Ensure compliance with regulatory standards such as PSD2.

Designing UI/UX

- Create wireframes, prototypes, and final designs for an intuitive interface.

- Align the design with the bank's brand image.

Back-end Development

- Integrate the app with core banking systems and customer databases.

- Establish communication and data exchange with payment gateways.

Security Implementation

- Implement strong encryption to protect customer data.

- Incorporate two-factor authentication to enhance security.

- Secure APIs to prevent unauthorized access.

- Apply data protection mechanisms like tokenization.

API Development

- Create APIs to integrate with third-party services such as payment processors and financial aggregators.

- Enable seamless data exchange and integration with these services.

Testing

- Conduct functional testing to ensure app functionalities work as expected.

- Perform usability testing to evaluate the user experience.

- Test for performance to ensure the app can handle user load.

- Conduct security penetration testing to identify vulnerabilities.

Deployment

- Prepare the necessary infrastructure for app deployment.

- Configure servers to support the app's functionality.

- Conduct final checks before deploying the app.

Ongoing Maintenance and Updates

- Regularly maintain and update the app to address any issues.

- Bug fixing to ensure optimal performance.

- Incorporate customer feedback to improve app features and usability.

- Stay updated with evolving technology and security requirements.

Why Choose QSS Technosoft for Mobile Banking App Development?

With over 15 years of expertise in fintech app development, QSS Technosoft brings deep industry knowledge to your project. Their seasoned team understands the unique challenges of financial technology.

They specialize in banking-grade security and regulatory compliance, ensuring your app meets the highest standards. Protecting sensitive data and maintaining trust is their top priority.

QSS Technosoft has a proven track record of delivering scalable and high-performance mobile banking apps. Their solutions are designed to grow with your business and handle increasing user demands.

Offering comprehensive end-to-end services, they support you from initial concept through to post-launch maintenance. This ensures a smooth development process and ongoing app success, answering the critical question: much does it cost to build a mobile banking app like First Direct?

Conclusion

Developing a mobile banking app similar to First Direct entails a significant commitment in terms of time, resources, and expertise. The cost of development will depend on various factors such as the intricacy of features, security considerations, third-party integrations, and the ongoing maintenance requirements.

However, by placing a strong emphasis on delivering a seamless user experience, prioritizing robust security measures, and collaborating with a proficient development team, you can create a mobile banking app that rivals the success of renowned industry leaders like First Direct.

If you're looking for a trusted partner to help you create a cutting-edge mobile banking app, you can just look no further than QSS Technosoft. As industry experts with extensive experience in developing financial applications, we at QSS Technosoft have the knowledge and skills required to bring your vision to life.

Contact QSS Technosoft today to discuss your requirements and embark on your journey towards building a game-changing mobile banking app.

We are proud to mention that our work has been recognized by leading B2B reviews and research platforms like GoodFirms, Clutch, MirrorView, and many more.

FAQs Section

How much does it cost to build a mobile banking app like First Direct?

The cost to build a mobile banking app like First Direct can vary widely depending on the app's complexity, features, security measures, and the development team's location and expertise. So, you might wonder, much does it cost to develop such an app? Typically, basic banking apps start around $40,000 to $60,000, while more advanced solutions with AI-powered features, multi-currency support, and personalized financial insights can exceed $120,000. Ongoing maintenance and compliance costs should also be factored into your budget.

What are the key features required in a successful banking app?

A successful banking app includes essential features such as secure user registration and login with biometric authentication, account management, real-time balance and transaction history, fund transfers, bill payments, and push notifications. Advanced features like AI chatbots, budgeting tools, card management, multi-currency support, and personalized financial analytics enhance user satisfaction and engagement.

How important are security and compliance in mobile banking app development?

Security and regulatory compliance are paramount in mobile banking app development. Robust security measures, including multi-factor authentication, end-to-end encryption, tokenization, and regular security audits, protect sensitive financial data and build user trust. Compliance with financial regulations such as PCI DSS, GDPR, and PSD2 ensures legal operation and minimizes risks related to data breaches and fraud.

What factors affect the mobile banking app development cost?

Several key factors influence the overall development cost, including app complexity, number of platforms supported (iOS, Android), design and user experience quality, integration with existing banking systems and third-party services, security requirements, and ongoing maintenance needs. The geographical location of the development team also significantly impacts hourly rates and total expenses.

How long does it take to develop a mobile banking app?

The development timeline depends on the app's complexity and feature set. Basic apps typically require 3 to 6 months, while more sophisticated apps with advanced features and integrations can take 6 to 12 months or longer. The development process includes planning, design, development, testing, deployment, and ongoing maintenance.

Can I integrate third-party services into my banking app?

Yes, integrating third-party services such as payment gateways, credit bureaus, identity verification, and financial management tools is common and often necessary to provide a comprehensive banking experience. These integrations require secure APIs and careful testing to ensure seamless functionality and compliance with security standards.

What is the role of ongoing maintenance in mobile banking apps?

Ongoing maintenance is essential to keep the app secure, up to date with the latest operating systems, and compliant with evolving regulations. It includes bug fixes, performance improvements, security patches, and feature updates based on user feedback and market demands. Maintenance typically accounts for 15-20% of the initial development cost annually.

How can I ensure a seamless user experience in my banking app?

Investing in intuitive UI/UX design, responsive user interfaces, fast load times, and clear navigation helps ensure a seamless user experience. Personalization features such as tailored financial insights and easy access to key functionalities also improve user satisfaction and retention.

What technologies are commonly used in mobile banking app development?

Popular frontend frameworks include React Native and Flutter for cross-platform development. Backend technologies like Node.js, Java, and .NET support business logic and integration with banking systems. Databases such as MySQL, PostgreSQL, and MongoDB provide scalable data storage. Cloud services like AWS and Azure offer reliable hosting and deployment infrastructure.

How do I choose the right development team for my banking app?

Selecting a development team with fintech expertise, strong security knowledge, and experience in regulatory compliance is crucial. Evaluate their portfolio, client reviews, and technical capabilities. Consider whether to hire in-house developers, outsource, or engage a hybrid team based on your budget, timeline, and project complexity.

How Much Does It Cost to Build a Mobile Banking App like First Direct?